--New series will begin today.

--GDP data will be released today.

--Nifty March future discount decreased to 20 points thus cost of carry increased.

--Nifty open interest decreased by 75 lacs suggests short covering. (new series begin with OI of 2.75cr)

--Put-Call Ratio increased to 1.39.

--2700 put had open interest of 59 lacs, so it will be imp level to watch for.

--implied volatility decreased by 300 basis points suggests stability.

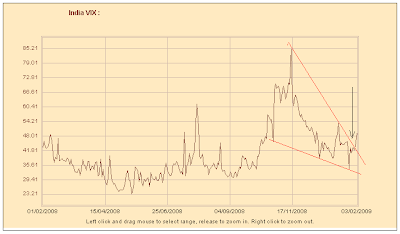

--India VIX closed at 39.87, decreased by 5% suggests stability.

--US markets closed in red.

--Asian markets trading mixed.

--Sgx nifty trading at 2758. (Down 13)

--Positional strategy for nifty—Neutral.

Friday, February 27, 2009

Thursday, February 26, 2009

CUES FOR FEB 26

--February series will close today. ( January series closed at 2824)

--Nifty Feb. future discount decreased to 5 points thus cost of carry increased.

--Nifty open interest decreased by 4 lacs suggests short covering.

--Nifty call option added 11 lacs and put option added 18 lacs.

--Put-Call Ratio increased to 1.12.

--implied volatility decreased by 300 basis points suggests stability.

--India VIX closed at 41.94, decreased by 7% suggests stability.

--US markets closed in red.

--Asian markets trading strong.

--Sgx nifty trading at 2752.

--Positional strategy for nifty—Hold short with closing stop loss of 2775. (Initiated at 2848).

--Nifty Feb. future discount decreased to 5 points thus cost of carry increased.

--Nifty open interest decreased by 4 lacs suggests short covering.

--Nifty call option added 11 lacs and put option added 18 lacs.

--Put-Call Ratio increased to 1.12.

--implied volatility decreased by 300 basis points suggests stability.

--India VIX closed at 41.94, decreased by 7% suggests stability.

--US markets closed in red.

--Asian markets trading strong.

--Sgx nifty trading at 2752.

--Positional strategy for nifty—Hold short with closing stop loss of 2775. (Initiated at 2848).

Wednesday, February 25, 2009

FUND FLOW UPDATE

************FUND FLOW UPDATE***********

(from http://www.sebi.gov.in/Index.jsp?contentDisp=FIITrends)

**Fund flow (February 18)

~FIIs net in Index fut. - 331 cr, FIIs net in Stock Fut. + 50 cr

~FIIs in Cash Market – 434 cr, Mut Funds in Cash Market - 106 cr

***total fund flow – 821 cr today.

**Fund flow (February 19)

~FIIs net in Index fut. + 114 cr, FIIs net in Stock Fut. + 116 cr

~FIIs in Cash Market – 320 cr, Mut Funds in Cash Market - 75 cr

***total fund flow – 165 cr today.

**Fund flow (February 20)

~FIIs net in Index fut. - 914 cr, FIIs net in Stock Fut. + 225 cr

~FIIs in Cash Market – 172 cr, Mut Funds in Cash Market - 334 cr

***total fund flow – 1195 cr today.

*** So far net fund flow of - 4141 cr in February series. (Nifty is also down in February series).

***Past fund flow (from June 2008 series)

- 8071 cr in June series (Nifty -520 in the series),

+ 6474 cr in July series (Nifty +18 in the series),

- 6641 cr in August series (Nifty -119 in the series),

- 6903 cr in September series (Nifty -104 in the series),

- 9863 cr in October series (Nifty -1413 in the series),

- 371 cr in November series (Nifty +58 in the series),

+ 3885 cr in December series (Nifty +162 in the series),

- 3643 cr in January series (Nifty -93 in the series).

(from http://www.sebi.gov.in/Index.jsp?contentDisp=FIITrends)

**Fund flow (February 18)

~FIIs net in Index fut. - 331 cr, FIIs net in Stock Fut. + 50 cr

~FIIs in Cash Market – 434 cr, Mut Funds in Cash Market - 106 cr

***total fund flow – 821 cr today.

**Fund flow (February 19)

~FIIs net in Index fut. + 114 cr, FIIs net in Stock Fut. + 116 cr

~FIIs in Cash Market – 320 cr, Mut Funds in Cash Market - 75 cr

***total fund flow – 165 cr today.

**Fund flow (February 20)

~FIIs net in Index fut. - 914 cr, FIIs net in Stock Fut. + 225 cr

~FIIs in Cash Market – 172 cr, Mut Funds in Cash Market - 334 cr

***total fund flow – 1195 cr today.

*** So far net fund flow of - 4141 cr in February series. (Nifty is also down in February series).

***Past fund flow (from June 2008 series)

- 8071 cr in June series (Nifty -520 in the series),

+ 6474 cr in July series (Nifty +18 in the series),

- 6641 cr in August series (Nifty -119 in the series),

- 6903 cr in September series (Nifty -104 in the series),

- 9863 cr in October series (Nifty -1413 in the series),

- 371 cr in November series (Nifty +58 in the series),

+ 3885 cr in December series (Nifty +162 in the series),

- 3643 cr in January series (Nifty -93 in the series).

CUES FOR FEB 25

--February series will close tomorrow. ( January series closed at 2824)

--Nifty Feb. future discount decreased to 8 points thus cost of carry increased.

--Nifty open interest increased by 8 lacs suggests long addition.

--Nifty call option added 5 lacs and put option added 16 lacs.

--Put-Call Ratio increased to 1.11.

--implied volatility increased by 900 basis points suggests volatility.

--India VIX closed at 45.2, unchanged suggests instability.

--US markets closed in green.

--Asian markets trading strong.

--Sgx nifty trading at 2760. (up 32)

--Positional strategy for nifty—Hold short with closing stop loss of 2779. (Initiated at 2848).

--Nifty Feb. future discount decreased to 8 points thus cost of carry increased.

--Nifty open interest increased by 8 lacs suggests long addition.

--Nifty call option added 5 lacs and put option added 16 lacs.

--Put-Call Ratio increased to 1.11.

--implied volatility increased by 900 basis points suggests volatility.

--India VIX closed at 45.2, unchanged suggests instability.

--US markets closed in green.

--Asian markets trading strong.

--Sgx nifty trading at 2760. (up 32)

--Positional strategy for nifty—Hold short with closing stop loss of 2779. (Initiated at 2848).

Tuesday, February 24, 2009

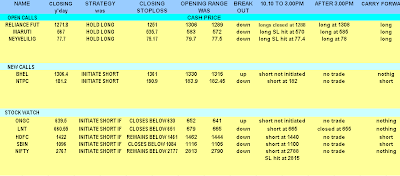

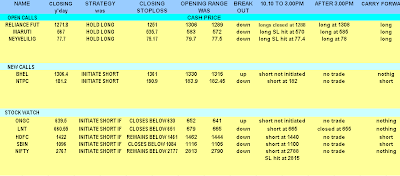

trading diary-24 feb

Nifty closed at-2736.

Strategy for day was- hold short.

Closing stoploss at- 2799.

Opening range (15 minutes) - 2720-2684.

Break out- down

10.10AM-3.00PM trading—SL hit at 2722.

After 3.00 PM trading- Short at 2740.

Carry forward- Short.

Strategy for day was- hold short.

Closing stoploss at- 2799.

Opening range (15 minutes) - 2720-2684.

Break out- down

10.10AM-3.00PM trading—SL hit at 2722.

After 3.00 PM trading- Short at 2740.

Carry forward- Short.

to understand please read

http://niftydoctor.blogspot.com/2009/01/trading-strategy-for-positional-calls.html

CUES FOR FEB 24

--Nifty Feb. future discount increased to 13 points thus cost of carry decreased.

--Nifty open interest increased by 16 lacs suggests short addition.

--Nifty call option added 32 lacs and put option added 7.5 lacs.

--Put-Call Ratio deceased to 1.09.

--2700 feb calls added 100%(13 lacs) open interest with decreased implied volatility suggest call writing.

--2700 march puts added 40%(10 lacs) open interest with increased implied volatility suggest put buying.

--so 2700 is imp level to watch for.

--Over all implied volatility remains flat suggest uncertainity.

--India VIX closed at 45.21, increased by 5% suggests instability.

--US markets closed in red. Dow closed at 11 year low.

--Asian markets trading in red.

--Sgx nifty trading at 2689.

--Positional strategy for nifty—hold short with closing stoploss of 2799(Initiated at 2848)

--Nifty open interest increased by 16 lacs suggests short addition.

--Nifty call option added 32 lacs and put option added 7.5 lacs.

--Put-Call Ratio deceased to 1.09.

--2700 feb calls added 100%(13 lacs) open interest with decreased implied volatility suggest call writing.

--2700 march puts added 40%(10 lacs) open interest with increased implied volatility suggest put buying.

--so 2700 is imp level to watch for.

--Over all implied volatility remains flat suggest uncertainity.

--India VIX closed at 45.21, increased by 5% suggests instability.

--US markets closed in red. Dow closed at 11 year low.

--Asian markets trading in red.

--Sgx nifty trading at 2689.

--Positional strategy for nifty—hold short with closing stoploss of 2799(Initiated at 2848)

Thursday, February 19, 2009

nifty chart

CUES FOR FEB 19

CUES-

--Nifty Feb. future discount decreased to 12.9 points thus cost of carry increased.

--Nifty open interest decreased by 0.5 lacs suggests short covering.

--Nifty call option added 16 lacs and put option added 21 lacs.

--Put-Call Ratio increased to 1.14.

--2700 puts had open interest of 58 lacs and now it will be important level to watch for.

--implied volatility decreased by 150 basis points suggests sideway trading. (OI increased of puts and calls both and IVs decreased in both suggest call and put writing)

--India VIX closed at 43.04, decreased by 2% suggests stability.

--US markets closed flat.

--Asian markets trading weak.

--Sgx nifty trading at 2742. (Down 25)

--Positional strategy for nifty—Hold short with closing stop loss of 2871. (Initiated at 2848).

--Nifty Feb. future discount decreased to 12.9 points thus cost of carry increased.

--Nifty open interest decreased by 0.5 lacs suggests short covering.

--Nifty call option added 16 lacs and put option added 21 lacs.

--Put-Call Ratio increased to 1.14.

--2700 puts had open interest of 58 lacs and now it will be important level to watch for.

--implied volatility decreased by 150 basis points suggests sideway trading. (OI increased of puts and calls both and IVs decreased in both suggest call and put writing)

--India VIX closed at 43.04, decreased by 2% suggests stability.

--US markets closed flat.

--Asian markets trading weak.

--Sgx nifty trading at 2742. (Down 25)

--Positional strategy for nifty—Hold short with closing stop loss of 2871. (Initiated at 2848).

Wednesday, February 18, 2009

CUES FOR FEB 18

CUES-

--Nifty Feb. future discount decreased to 16.9 points thus cost of carry increased.

--Nifty open interest decreased by 2.4 lacs suggests short covering.

--Nifty call option added 27 lacs and put option shed 3 lacs.

--Put-Call Ratio decreased to 1.12.

--2800 puts had open interest of 49 lacs and now 2800 level is also broken. (OI reduced by 43 lacs in 4 days).

--implied volatility decreased by 100 basis points suggests bearishness. (OI of calls increased and IVs decreased so call writing)

--India VIX closed at 44.00, increased by 3% suggests instability.

--US markets closed in red.

--Asian markets trading weak.

--Sgx nifty trading at 2730. (Down 31)

--Positional strategy for nifty—Hold short with closing stop loss of 2926. (Initiated at 2848).

--Nifty Feb. future discount decreased to 16.9 points thus cost of carry increased.

--Nifty open interest decreased by 2.4 lacs suggests short covering.

--Nifty call option added 27 lacs and put option shed 3 lacs.

--Put-Call Ratio decreased to 1.12.

--2800 puts had open interest of 49 lacs and now 2800 level is also broken. (OI reduced by 43 lacs in 4 days).

--implied volatility decreased by 100 basis points suggests bearishness. (OI of calls increased and IVs decreased so call writing)

--India VIX closed at 44.00, increased by 3% suggests instability.

--US markets closed in red.

--Asian markets trading weak.

--Sgx nifty trading at 2730. (Down 31)

--Positional strategy for nifty—Hold short with closing stop loss of 2926. (Initiated at 2848).

NOTE--These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice.

Tuesday, February 17, 2009

CUES FOR FEB 17

CUES-

--Nifty Feb. future discount increased to 17 points thus cost of carry decreased.

--Nifty open interest decreased by 20 lacs suggests long unwinding.

--Nifty call option added 27 lacs and put option shed 7 lacs.

--Put-Call Ratio decreased to 1.22.

--2800 puts had open interest of 63 lacs, so it will be trend deciding level to watch for.

--implied volatility remains same suggest volatility.

--India VIX closed at 42.56, decreased by 2% suggests stability.

--European markets closed in red. (US markets were closed on Monday).

--Asian markets trading weak.

--Sgx nifty trading at 2810. (Down 18)

--Positional strategy for nifty—neutral (Initiate short if remains below 2874).

--Nifty Feb. future discount increased to 17 points thus cost of carry decreased.

--Nifty open interest decreased by 20 lacs suggests long unwinding.

--Nifty call option added 27 lacs and put option shed 7 lacs.

--Put-Call Ratio decreased to 1.22.

--2800 puts had open interest of 63 lacs, so it will be trend deciding level to watch for.

--implied volatility remains same suggest volatility.

--India VIX closed at 42.56, decreased by 2% suggests stability.

--European markets closed in red. (US markets were closed on Monday).

--Asian markets trading weak.

--Sgx nifty trading at 2810. (Down 18)

--Positional strategy for nifty—neutral (Initiate short if remains below 2874).

NOTE--These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice.

Friday, February 13, 2009

CUES FOR FEB 13

CUES-

--Nifty Feb. future discount increased to 6 points thus cost of carry decreased.

--Nifty open interest decreased by 7 lacs suggests long unwinding.

--Nifty call option added 10 lacs and put option shed 7 lacs.

--2800 puts had open interest of 87 lacs, so it will be a trend deciding level to watch for.

--Put-Call Ratio decreased to 1.26.

--Implied Volatility of options decreased by 150 basis points indicates bullishness.

--India VIX closed at 45.65, decreased by 2% suggests stability.

--US markets closed flat.

--Asian markets trading sfrong.

--Sgx nifty trading at 2915. (up 23)

--Positional strategy for nifty—Hold Long with closing stop loss of 2885. (Initiated at 2843)

--Nifty Feb. future discount increased to 6 points thus cost of carry decreased.

--Nifty open interest decreased by 7 lacs suggests long unwinding.

--Nifty call option added 10 lacs and put option shed 7 lacs.

--2800 puts had open interest of 87 lacs, so it will be a trend deciding level to watch for.

--Put-Call Ratio decreased to 1.26.

--Implied Volatility of options decreased by 150 basis points indicates bullishness.

--India VIX closed at 45.65, decreased by 2% suggests stability.

--US markets closed flat.

--Asian markets trading sfrong.

--Sgx nifty trading at 2915. (up 23)

--Positional strategy for nifty—Hold Long with closing stop loss of 2885. (Initiated at 2843)

Thursday, February 12, 2009

FUND FLOW UPDATE

************FUND FLOW UPDATE***********

(from http://www.sebi.gov.in/Index.jsp?contentDisp=FIITrends)

**Fund flow (January 30)

~FIIs net in Index fut. + 29 cr, FIIs net in Stock Fut. - 91 cr

~FIIs in Cash Market – 17 cr, Mut Funds in Cash Market + 535 cr

***total fund flow + 456 cr today & nifty was up by 51 points.

**Fund flow (February 2)

~FIIs net in Index fut. - 626 cr, FIIs net in Stock Fut. - 12cr

~FIIs in Cash Market – 12 cr, Mut Funds in Cash Market - 454 cr

***total fund flow – 1104 cr today & nifty was down by 108 points.

**Fund flow (February 3)

~FIIs net in Index fut. + 276 cr, FIIs net in Stock Fut. - 20 cr

~FIIs in Cash Market – 161 cr, Mut Funds in Cash Market - 126 cr

***total fund flow – 31 cr today.

**Fund flow (February 4)

~FIIs net in Index fut. + 309 cr, FIIs net in Stock Fut. + 127 cr

~FIIs in Cash Market – 24 cr, Mut Funds in Cash Market + 45cr

***total fund flow + 457 cr today.

**Fund flow (February 5)

~FIIs net in Index fut. - 221 cr, FIIs net in Stock Fut. + 135 cr

~FIIs in Cash Market + 51 cr, Mut Funds in Cash Market - 205 cr

***total fund flow – 240 cr today.

**Fund flow (February 6)

~FIIs net in Index fut. + 376 cr, FIIs net in Stock Fut. - 243 cr

~FIIs in Cash Market + 60 cr, Mut Funds in Cash Market + 139cr

***total fund flow + 332 cr today.

**Fund flow (February 9)

~FIIs net in Index fut. + 345 cr, FIIs net in Stock Fut. + 202 cr

~FIIs in Cash Market + 289 cr, Mut Funds in Cash Market + 63 cr

***total fund flow + 899 cr today.

**Fund flow (February 10)

~FIIs net in Index fut. + 39 cr, FIIs net in Stock Fut. + 170 cr

~FIIs in Cash Market + 416 cr, Mut Funds in Cash Market - 37 cr

***total fund flow + 588 cr today.

**Fund flow (February 11)

~FIIs net in Index fut. + 21 cr, FIIs net in Stock Fut. - 271 cr

~FIIs in Cash Market – 114 cr, Mut Funds in Cash Market - 97 cr

***total fund flow – 461 cr today.

*** So far net fund flow of + 1026 cr in February series. (Nifty is also up in February series).

(from http://www.sebi.gov.in/Index.jsp?contentDisp=FIITrends)

**Fund flow (January 30)

~FIIs net in Index fut. + 29 cr, FIIs net in Stock Fut. - 91 cr

~FIIs in Cash Market – 17 cr, Mut Funds in Cash Market + 535 cr

***total fund flow + 456 cr today & nifty was up by 51 points.

**Fund flow (February 2)

~FIIs net in Index fut. - 626 cr, FIIs net in Stock Fut. - 12cr

~FIIs in Cash Market – 12 cr, Mut Funds in Cash Market - 454 cr

***total fund flow – 1104 cr today & nifty was down by 108 points.

**Fund flow (February 3)

~FIIs net in Index fut. + 276 cr, FIIs net in Stock Fut. - 20 cr

~FIIs in Cash Market – 161 cr, Mut Funds in Cash Market - 126 cr

***total fund flow – 31 cr today.

**Fund flow (February 4)

~FIIs net in Index fut. + 309 cr, FIIs net in Stock Fut. + 127 cr

~FIIs in Cash Market – 24 cr, Mut Funds in Cash Market + 45cr

***total fund flow + 457 cr today.

**Fund flow (February 5)

~FIIs net in Index fut. - 221 cr, FIIs net in Stock Fut. + 135 cr

~FIIs in Cash Market + 51 cr, Mut Funds in Cash Market - 205 cr

***total fund flow – 240 cr today.

**Fund flow (February 6)

~FIIs net in Index fut. + 376 cr, FIIs net in Stock Fut. - 243 cr

~FIIs in Cash Market + 60 cr, Mut Funds in Cash Market + 139cr

***total fund flow + 332 cr today.

**Fund flow (February 9)

~FIIs net in Index fut. + 345 cr, FIIs net in Stock Fut. + 202 cr

~FIIs in Cash Market + 289 cr, Mut Funds in Cash Market + 63 cr

***total fund flow + 899 cr today.

**Fund flow (February 10)

~FIIs net in Index fut. + 39 cr, FIIs net in Stock Fut. + 170 cr

~FIIs in Cash Market + 416 cr, Mut Funds in Cash Market - 37 cr

***total fund flow + 588 cr today.

**Fund flow (February 11)

~FIIs net in Index fut. + 21 cr, FIIs net in Stock Fut. - 271 cr

~FIIs in Cash Market – 114 cr, Mut Funds in Cash Market - 97 cr

***total fund flow – 461 cr today.

*** So far net fund flow of + 1026 cr in February series. (Nifty is also up in February series).

CUES FOR FEB 12

CUES-

--Nifty Feb. future discount decreased to 2 points thus cost of carry increased.

--Nifty open interest increased by 11 lacs suggests long accumulation.

--Nifty call option added 9 lacs and put option added 14 lacs.

--2800 puts had open interest of 92 lacs, so it will be a trend deciding level to watch for.

--Put-Call Ratio increased to 1.35.

--Implied Volatility of options increased by 200 basis points indicates bearishness.

--India VIX closed at 46.65, increased by 4% suggests instability.

--US markets closed in green.

--Asian markets trading weak.

--Sgx nifty trading at 2905. (down 25)

--Positional strategy for nifty—Hold Long with closing stop loss of 2870. (Initiated at 2843)

--Nifty Feb. future discount decreased to 2 points thus cost of carry increased.

--Nifty open interest increased by 11 lacs suggests long accumulation.

--Nifty call option added 9 lacs and put option added 14 lacs.

--2800 puts had open interest of 92 lacs, so it will be a trend deciding level to watch for.

--Put-Call Ratio increased to 1.35.

--Implied Volatility of options increased by 200 basis points indicates bearishness.

--India VIX closed at 46.65, increased by 4% suggests instability.

--US markets closed in green.

--Asian markets trading weak.

--Sgx nifty trading at 2905. (down 25)

--Positional strategy for nifty—Hold Long with closing stop loss of 2870. (Initiated at 2843)

Wednesday, February 11, 2009

CUES FOR FEB 11

CUES-

--Uptrend is now 3 days old and can maximum last for 4-6 days.

--Nifty Feb. future discount decreased to 7 points thus cost of carry increased.

--Nifty open interest increased by 1.2 lacs suggests long accumulation.

--Nifty call option added 13 lacs and put option added 20 lacs.

--2800 puts had open interest of 85 lacs, so it will be a trend deciding level to watch for.

--Put-Call Ratio increased to 1.34.

--Implied Volatility of options decreased by 100 basis points indicates bullishness.

--India VIX closed at 44.30, decreased by 12% suggests stability.

--US markets closed in deep red.

--Asian markets trading weak.

--Sgx nifty trading at 2772. (down 49)

--Positional strategy for nifty—Hold Long with closing stop loss of 2837. (Initiated at 2843)

TODAY BREAKOUT FROM OPENING RANGE OF FIRST 15 MINUTES WILL BE VERY IMPORTANT CUE FOR TRADERS.

--Uptrend is now 3 days old and can maximum last for 4-6 days.

--Nifty Feb. future discount decreased to 7 points thus cost of carry increased.

--Nifty open interest increased by 1.2 lacs suggests long accumulation.

--Nifty call option added 13 lacs and put option added 20 lacs.

--2800 puts had open interest of 85 lacs, so it will be a trend deciding level to watch for.

--Put-Call Ratio increased to 1.34.

--Implied Volatility of options decreased by 100 basis points indicates bullishness.

--India VIX closed at 44.30, decreased by 12% suggests stability.

--US markets closed in deep red.

--Asian markets trading weak.

--Sgx nifty trading at 2772. (down 49)

--Positional strategy for nifty—Hold Long with closing stop loss of 2837. (Initiated at 2843)

TODAY BREAKOUT FROM OPENING RANGE OF FIRST 15 MINUTES WILL BE VERY IMPORTANT CUE FOR TRADERS.

Monday, February 9, 2009

FOR FEB 9

SUMMARY--------

--Nifty Feb. future discount decreased to 12 points thus cost of carry increased.

--Nifty open interest increased by 10 lacs suggests long accumulation.

--Nifty call option added 8 lacs and put option added 44 lacs.

--Put-Call Ratio increased to 1.2.

--Implied Volatility of options decreased by 100 basis points indicates bullishness.

--India VIX closed at 50.65, increased by 12% suggests instability.

--US markets closed in green. Dow was up by more than 200 points from intraday low.

--Asian markets trading strong.

--Sgx nifty trading at 2854. (Up 20)

--Open interest gainers—orbit, prism cement, SAIL, peninsula.

--Open interest losers—Ansal properties, HDFC bank, GSPL.

--Positional strategy for nifty—Hold Long with closing stop loss of 2771. (Initiated at 2843)

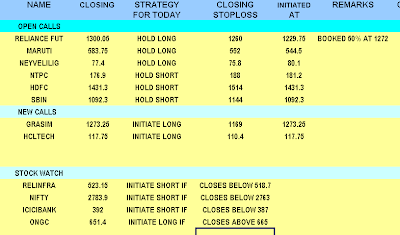

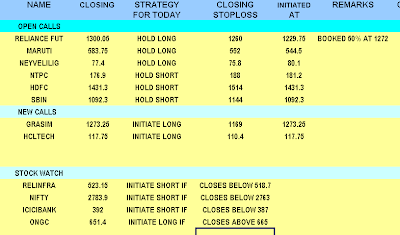

************CALLS FOLLOW UP AS PER FEB 6 TRADING DIARY

NOTE--These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice.

NOTE--These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice.

--Nifty Feb. future discount decreased to 12 points thus cost of carry increased.

--Nifty open interest increased by 10 lacs suggests long accumulation.

--Nifty call option added 8 lacs and put option added 44 lacs.

--Put-Call Ratio increased to 1.2.

--Implied Volatility of options decreased by 100 basis points indicates bullishness.

--India VIX closed at 50.65, increased by 12% suggests instability.

--US markets closed in green. Dow was up by more than 200 points from intraday low.

--Asian markets trading strong.

--Sgx nifty trading at 2854. (Up 20)

--Open interest gainers—orbit, prism cement, SAIL, peninsula.

--Open interest losers—Ansal properties, HDFC bank, GSPL.

--Positional strategy for nifty—Hold Long with closing stop loss of 2771. (Initiated at 2843)

************CALLS FOLLOW UP AS PER FEB 6 TRADING DIARY

NOTE--These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice.

NOTE--These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice.Saturday, February 7, 2009

MY E-MAILNEWSLETTER SERVICE

Dear viewers,

-as you all know we have started our newsletter service from 30 january.

-We give two E-Mail everyday,one before market opens for calls and one after market hours as trading diary.

-please look at the pictures how our calls performed in sideway market.

why our calls performed well inspite of sideway market??

-because we believe that

************CALLS FOR JAN 30*****

*******CALLS FOR FEB 2******

*******CALLS FOR FEB 2****** *********TRADING DIARY FEB 2***

*********TRADING DIARY FEB 2***

**********TRADING DIARY FEB 3********

********CALLS FEB 4

*******TRADING DIARY FEB 4

***********CALLS FEB 5*****

*************TRADING DIARY FEB 5**********

*********CALLS FEB 6*******

-as you all know we have started our newsletter service from 30 january.

-We give two E-Mail everyday,one before market opens for calls and one after market hours as trading diary.

-please look at the pictures how our calls performed in sideway market.

why our calls performed well inspite of sideway market??

-because we believe that

- always try to follow the market and do not try to predict the market.

- mechanical traders make money and emotional traders loose money in market.

- always follow the price as price tell every thing.

************CALLS FOR JAN 30*****

*********TRADING DIARY FEB 2***

*********TRADING DIARY FEB 2***

*********CALLS FOR FEB 3*******

**********TRADING DIARY FEB 3********

********CALLS FEB 4

*******TRADING DIARY FEB 4

***********CALLS FEB 5*****

*************TRADING DIARY FEB 5**********

*********CALLS FEB 6*******

**********TRADING DIARY FEB 6*********

NOTE--These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice.

Friday, February 6, 2009

FOR FEB 6

--Nifty Feb. future discount decreased to 14 points thus cost of carry increased.

--Nifty open interest decreased by 12 lacs suggests short covering.

--Nifty call option added 14 lacs and put option added 24 lacs.

--Put-Call Ratio increased to 1.1.

--India VIX closed at 43.92, decreased by 2% suggests stability.

--US markets closed in green. Dow was up by more than 200 points from intraday low.

--Asian markets trading strong.

--Sgx nifty trading at 2820. (Up 47)

--Open interest gainers—SCI, Sesa goa, Akruti.

--Open interest losers—Dish TV, Dabur, Sun TV.

--Positional strategy for nifty—neutral.(short below 2763 and long above 2842)

Thursday, February 5, 2009

for feb 5

--Nifty Feb. future discount increased to 22 points thus cost of carry decreased.

--Nifty open interest increased by 6 lacs suggests short addition.

--Nifty call option added 24.5 lacs and put option added 26 lacs.

--Put-Call Ratio remains at 1.07.

--India VIX closed at 44.39, decreased by 9% suggests stability.

--US markets closed in red. Dow was down by more than 200 from intraday high

--Asian markets trading mixed.

--Sgx nifty trading at 2774. (flat)

--Open interest gainers—WWIL, Dish TV, REC, Ballarpur ind.

--Open interest losers—TV 18, Dena bank, Polaris, Finan Tech.

--Positional strategy for nifty—neutral.(short below 2765)

--Nifty open interest increased by 6 lacs suggests short addition.

--Nifty call option added 24.5 lacs and put option added 26 lacs.

--Put-Call Ratio remains at 1.07.

--India VIX closed at 44.39, decreased by 9% suggests stability.

--US markets closed in red. Dow was down by more than 200 from intraday high

--Asian markets trading mixed.

--Sgx nifty trading at 2774. (flat)

--Open interest gainers—WWIL, Dish TV, REC, Ballarpur ind.

--Open interest losers—TV 18, Dena bank, Polaris, Finan Tech.

--Positional strategy for nifty—neutral.(short below 2765)

Wednesday, February 4, 2009

feb 4

-India VIX closed at 49.24.

-India VIX closed at 49.24.-it breaks the resistance on upside which is very bearish.

SUMMARY-

--Nifty Feb. future discount decreased to 19 points thus cost of carry increased.

--Nifty open interest decreased by 1.1 lacs suggests short unwinding.

--Nifty call option added 7.5 lacs and put option added 32 lacs.

--Put-Call Ratio increased to 1.07.

--India VIX closed at 49.24, increased by 12% suggests uncertainity.

--US markets closed in green.

--Asian markets trading in green.

--Sgx nifty trading at 2792. (Up 21)

--Open interest gainers—Zee, NIIT, DLF, Educomp, Grasim.

--Open interest losers—GSPL, Dena bank, Polaris.

--Positional strategy for nifty—neutral.

Tuesday, February 3, 2009

trading diary

our calls were for day-----

how we trade today inspite of volatility.

how we trade today inspite of volatility.

to understand the trading please read http://niftydoctor.blogspot.com/2009/01/trading-strategy-for-positional-calls_25.html

to understand the trading please read http://niftydoctor.blogspot.com/2009/01/trading-strategy-for-positional-calls_25.html

how we trade today inspite of volatility.

how we trade today inspite of volatility. to understand the trading please read http://niftydoctor.blogspot.com/2009/01/trading-strategy-for-positional-calls_25.html

to understand the trading please read http://niftydoctor.blogspot.com/2009/01/trading-strategy-for-positional-calls_25.html now we are holding longs in reliance,maruti,nevyeli and holding shorts in ntpc,sbin,hdfc.

NOTE--These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice.

FOR FEB 3

--nifty feb future discount increased to 31 points thus cost of carry decreased.

--nifty open interest decreased by 13 lacs suggests long unwinding.

--nifty call option added 44 lacs and put option shed 12 lacs.

--put-call ratio decreased to 0.99.

--India VIX closed at 43.69, increased by 4% suggests uncertainity.

--US markets closed sideways but dow breaks the low of January and closed below 8000 after long time.

--Asian markets trading in green.

--Sgx nifty trading at 2769. (up 31)

--open interest gainers—educomp, bank of India, axis bank, united spirit.

--open interest losers—jp asso., biocon, gvk power.

--positional strategy for nifty—neutral.

--nifty open interest decreased by 13 lacs suggests long unwinding.

--nifty call option added 44 lacs and put option shed 12 lacs.

--put-call ratio decreased to 0.99.

--India VIX closed at 43.69, increased by 4% suggests uncertainity.

--US markets closed sideways but dow breaks the low of January and closed below 8000 after long time.

--Asian markets trading in green.

--Sgx nifty trading at 2769. (up 31)

--open interest gainers—educomp, bank of India, axis bank, united spirit.

--open interest losers—jp asso., biocon, gvk power.

--positional strategy for nifty—neutral.

Monday, February 2, 2009

for feb 2

--nifty feb future discount decreased to 7 points thus cost of carry increased.

--nifty open interest increased by 16 lacs suggests long buildup.

--nifty call option added 18 lacs and put option added 49 lacs.

--put-call ratio increased to 1.21.

--India VIX closed at 42.10, decreased by 2% suggests stability.

--US markets closed in red.

--Asian markets trading sideway.

--high court order in RIL case will be positive for market.

--Sgx nifty trading at 2840. (-21)

--open interest gainers—biocon, JP associates, jet airways, gvk power, indiabulls real estate.

--open interest losers—dabur, hpcl, aurobindo, obc.

--positional strategy—hold longs in nifty with closing stoploss of 2778.

--nifty open interest increased by 16 lacs suggests long buildup.

--nifty call option added 18 lacs and put option added 49 lacs.

--put-call ratio increased to 1.21.

--India VIX closed at 42.10, decreased by 2% suggests stability.

--US markets closed in red.

--Asian markets trading sideway.

--high court order in RIL case will be positive for market.

--Sgx nifty trading at 2840. (-21)

--open interest gainers—biocon, JP associates, jet airways, gvk power, indiabulls real estate.

--open interest losers—dabur, hpcl, aurobindo, obc.

--positional strategy—hold longs in nifty with closing stoploss of 2778.

Subscribe to:

Posts (Atom)