• In the medium term,

--- Nifty is in corrective down move (from 21st Jan.) with targets of 5010 (achieved), 4950 (achieved), 4890 (achieved).

--- The down move will ‘terminate’ above 5292.

• In the short term,

--- Nifty is in downtrend (from 21st Jan.) with targets of 5090 (already achieved), 5020 (achieved).

----The down trend will ‘terminate’ above 4930.

• In the immediate term

---- Nifty was in corrective up move (from 28th Jan.) which is terminated now.

----Nifty is again in corrective up move now with targets of 4910, 4930, 4960, 5010.

--- The up move will terminate below 4766.

Friday, January 29, 2010

Thursday, January 28, 2010

NIFTY TREND WATCH-JAN 29

• In the medium term,

--- Nifty is in corrective down move (from 21st Jan.) with targets of 5010 (achieved), 4950 (achieved), 4890 (achieved).

--- The down move will ‘terminate’ above 5311.

• In the short term,

--- Nifty is in downtrend (from 21st Jan.) with targets of 5090 (already achieved), 5020 (achieved).

----The down trend will ‘terminate’ above 5292.

• In the immediate term

---- Nifty is now in corrective up move with targets of 5000, 5050, 5110.

--- The up move will terminate below 4825.

--- Nifty is in corrective down move (from 21st Jan.) with targets of 5010 (achieved), 4950 (achieved), 4890 (achieved).

--- The down move will ‘terminate’ above 5311.

• In the short term,

--- Nifty is in downtrend (from 21st Jan.) with targets of 5090 (already achieved), 5020 (achieved).

----The down trend will ‘terminate’ above 5292.

• In the immediate term

---- Nifty is now in corrective up move with targets of 5000, 5050, 5110.

--- The up move will terminate below 4825.

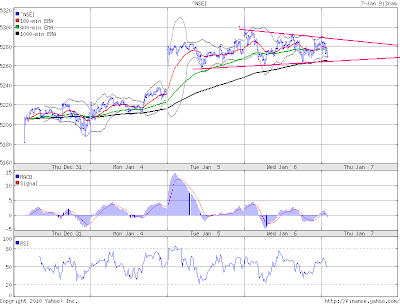

RSI-POSITIVE DIVERGENCE

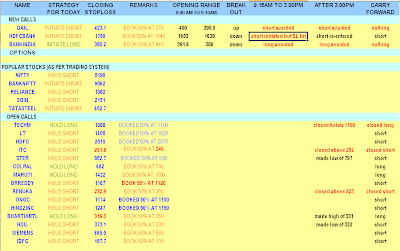

CALLS-JAN 28

-----NIFTYDOCTOR’S TRADE PRESCRIPTION-----

CALLS---

• File of today’s calls attached.

• In calls, book 50% at target and close 100% when trailing stop loss hits.

• Initiate position in new calls as per ORB strategy.

• All calls are given full follow up even if not initiated as per ORB strategy.

• It is advisable to monitor positions in open and other calls as per ORB strategy.

• To view ORB strategy visit at http://niftydoctor.blogspot.com/2009/04/opening-range-breakout.html

• In all calls average of last three days low is stop loss for longs and average of highs is stop loss for shorts.

• Intraday calls section added from today.

TECHNICAL CUES-------

• Nifty made high and low of 5008 and 4833 on last trading day.

• Trading above 4905, up move will be seen up to 4930, 4950, 4970.

• Below 4833, correction will be seen up to 4810, 4790, 4770.

• Last swing top is at 5292.

• In the medium term,

--- Nifty is in corrective down move (from 21st Jan.) with targets of 5010 (achieved), 4950 (achieved), 4890 (achieved).

--- The down move will ‘terminate’ above 5311.

• In the short term,

--- Nifty is now in downtrend (from 21st Jan.) with targets of 5090 (already achieved), 5020 (achieved).

----The down trend will ‘terminate’ above 5292.

DERIVATIVE CUES----

• Nifty February future premium converted in to discount of 6 points so cost of carry decreased. (Bearish)

• Nifty open interest increased by 61 lacs !!!!!!!!!!! suggests short addition. (Total OI now at 3.95cr which is very dangerous and can lead to high volatility in coming days )• Nifty calls added 97 lacs and puts added 14 lacs in open interest. (Bearish)

• Nifty open interest put-call ratio is at 0.9.

• 4800 puts had open interest of 43 lacs (+18%) and 4900 calls had open interest of 44 lacs (+430%), so 4800 and 4900 will be important levels to watch for.

• India VIX closed at 28.92, increased by 12% suggests instability. (Bearish)

• In Nifty stocks, advance-decline ratio is 0/50. (Bearish)

Wednesday, January 27, 2010

all targets achieved

I said on 21st January here in the blog that

''In the medium term,

--- Nifty is in corrective down move (from 21st Jan.) with targets of 5010 (achieved), 4950 (achieved), 4890.''

Today Nifty made low of 4890.6 so far.

cheers.

''In the medium term,

--- Nifty is in corrective down move (from 21st Jan.) with targets of 5010 (achieved), 4950 (achieved), 4890.''

Today Nifty made low of 4890.6 so far.

cheers.

CALLS E-MAIL-JAN 27

-----NIFTYDOCTOR’S TRADE PRESCRIPTION-----

CALLS---

• File of today’s calls attached. (New calls avoided as there is likely gap down opening)

• In calls, book 50% at target and close 100% when trailing stop loss hits.

• Initiate position in new calls as per ORB strategy.

• All calls are given full follow up even if not initiated as per ORB strategy.

• It is advisable to monitor positions in open and other calls as per ORB strategy.

• To view ORB strategy visit at http://niftydoctor.blogspot.com/2009/04/opening-range-breakout.html

• In all calls average of last three days low is stop loss for longs and average of highs is stop loss for shorts.

TECHNICAL CUES-------

• Nifty made high and low of 5036 and 4983 on last trading day.

• Trading above 5025, up move will be seen up to 5040, 5060, 5080.

• Below 4983, correction will be seen up to 4950, 4930, 4910.

• Last swing top is at 5292.

• In the medium term,

--- Nifty is in corrective down move (from 21st Jan.) with targets of 5010 (achieved), 4950 (achieved), 4890.

--- The down move will ‘terminate’ above 5311.

• In the short term,

--- Nifty is now in downtrend (from 21st Jan.) with targets of 5090 (already achieved), 5020 (achieved).

----The down trend will ‘terminate’ above 5292.

DERIVATIVE CUES----

• Nifty January future discount decreased to 6 points so cost of carry increased. (Bullish)

• Nifty open interest increased by 7 lacs suggests long addition. (Total OI now at 3.34cr which is very dangerous and can lead to high volatility in coming days )

• Nifty calls added 17 lacs and puts added 4 lacs in open interest. (Bearish)

• Nifty open interest put-call ratio is at 1.02.

• 5000 puts had open interest of 52 lacs (-10%) and 5100 calls had open interest of 39 lacs (-4%), so 5000 and 5100 will be important levels to watch for.

• India VIX closed at 25.82, increased by 3.9% suggests instability. (Bearish)

• In Nifty stocks, advance-decline ratio is 13/37. (Bearish)

Tuesday, January 26, 2010

Monday, January 25, 2010

Trading Diary-Jan 25

• Nifty after opening around 4990 traded in 4983-5024 range initially and then break out from it occurs on up side. Nifty made high of 5036 and nifty closed around 5008.

• Inside day formed today in Nifty.

• Long in TECHM and short in RENUKA, ITC closed today.

• Short in STER, HDIL and long in BHARTIARTL performed well today.

• Among new calls, short initiated in HDFCBANK as per ORB strategy.

Sunday, January 24, 2010

CALLS E-MAIL- JAN 25

Dear Viewers,

My E-mail service is now one year old.

The service was started on 29th Jan.2009.

On completion of one year all my E-mails will be shared here for next few days.

with regards.

-Dr.Jignesh Shah.

-----NIFTYDOCTOR’S TRADE PRESCRIPTION-----

CALLS---

• File of today’s calls attached.

• In calls, book 50% at target and close 100% when trailing stop loss hits.

• Initiate position in new calls as per ORB strategy.

• All calls are given full follow up even if not initiated as per ORB strategy.

• It is advisable to monitor positions in open and other calls as per ORB strategy.

• To view ORB strategy visit at http://niftydoctor.blogspot.com/2009/04/opening-range-breakout.html

• In all calls average of last three days low is stop loss for longs and average of highs is stop loss for shorts.

TECHNICAL CUES-------

• Nifty made high and low of 5094 and 4955 on last trading day.

• Trading above 5050, up move will be seen up to 5070, 5080, 5090.

• Below 5020, correction will be seen up to 4990, 4970, 4950.

• Last swing top is at 5292.

• In the medium term,

--- Nifty is in corrective down move (from 21st Jan.) with targets of 5010 (achieved), 4950 (achieved), 4890.

--- The down move will ‘terminate’ above 5311.

• In the short term,

--- Nifty is now in downtrend (from 21st Jan.) with targets of 5090 (already achieved), 5020 (achieved).

----The down trend will ‘terminate’ above 5292.

DERIVATIVE CUES----

• Nifty January future discount increased to 16 points so cost of carry decreased. (Bearish)

• Nifty open interest increased by 23 lacs suggests short addition. (Total OI now at 3.27cr which is very dangerous suggest high volatility in next three days)

• Nifty calls added 61 lacs and puts added 12 lacs in open interest. (Bearish)

• Nifty open interest put-call ratio is at 1.04.

• 5000 puts had open interest of 58 lacs (-10%) and 5100 calls had open interest of 41 lacs (+23%), so 5000 and 5100 will be important levels to watch for.

• India VIX closed at 24.85, increased by 5.7% suggests instability. (Bearish)

• In Nifty stocks, advance-decline ratio is 8/41. (Bearish)

Important Disclaimer: -

The information and views in this newsletter we provide are believed to be reliable, but we do not accept any responsibility (or liability) for errors of fact or opinion. Investment in equity shares has its own risks. Sincere efforts have been made to present the right investment perspective. The information contained herein is based on analysis that we consider reliable. We, however, do not vouch for the accuracy or the completeness thereof. This material is for personal information and we are not responsible for any loss incurred based upon it & take no responsibility whatsoever for any financial profits or loss which may arise from the recommendations above. The information herein, together with all estimates and forecasts, can change without notice.

Analyst or any person related to nifty doctor may or may not be holding positions in the stocks recommended. It is understood that anyone who is browsing through the newsletter has done so at his free will and does not read any views expressed as a recommendation for which either the site or its owners or anyone can be held responsible for. Our Clients (Paid Or Unpaid), Any third party or anyone else have no rights to forward or share our calls or Any Information Provided by us to/with anyone which is received directly or indirectly by them. If found so then Serious Legal Actions can be taken.

Thursday, January 21, 2010

Nifty Trend-Jan 22

• In the medium term,

--- Nifty was in uptrend (from 23rd Dec.) which is terminated now.

--- Nifty is now in corrective down move with targets of 5010, 4950, 4890.

--- The down move will ‘terminate’ above 5311.

• In the short term,

--- Nifty is now in downtrend (from 21st Jan) with targets of 5090 (already achieved), 5020.

----The down trend will ‘terminate’ above 5292.

--- Nifty was in uptrend (from 23rd Dec.) which is terminated now.

--- Nifty is now in corrective down move with targets of 5010, 4950, 4890.

--- The down move will ‘terminate’ above 5311.

• In the short term,

--- Nifty is now in downtrend (from 21st Jan) with targets of 5090 (already achieved), 5020.

----The down trend will ‘terminate’ above 5292.

Wednesday, January 20, 2010

NIFTY TREND-JAN 21

• Last swing top is at 5292.

• In the medium term,

--- Nifty is in uptrend (from 23rd Dec.) with targets of 5240(achieved), 5360.

---The uptrend will ‘terminate’ below 5169.

• In the short term,

--- Nifty is in corrective down move with targets of 5210 (achieved), 5195.

--- The down move will ‘terminate’ above 5292.

• In the medium term,

--- Nifty is in uptrend (from 23rd Dec.) with targets of 5240(achieved), 5360.

---The uptrend will ‘terminate’ below 5169.

• In the short term,

--- Nifty is in corrective down move with targets of 5210 (achieved), 5195.

--- The down move will ‘terminate’ above 5292.

Tuesday, January 19, 2010

Nifty Trend-Jan 20

• Last swing top is at 5292.

• In the medium term,

--- Nifty is in uptrend (from 23rd Dec.) with targets of 5240(achieved), 5360.

---The uptrend will ‘terminate’ below 5169.

• In the short term,

--- Nifty was in uptrend which is terminated now.

---Nifty is now in corrective down move with targets of 5210, 5195.

----The down move will ‘terminate’ above 5292.

• In the medium term,

--- Nifty is in uptrend (from 23rd Dec.) with targets of 5240(achieved), 5360.

---The uptrend will ‘terminate’ below 5169.

• In the short term,

--- Nifty was in uptrend which is terminated now.

---Nifty is now in corrective down move with targets of 5210, 5195.

----The down move will ‘terminate’ above 5292.

Monday, January 18, 2010

Nifty Trend-Jan 19

• Last swing bottom is at 5229.

• In the medium term,

--- Nifty is in uptrend (from 23rd Dec.) with targets of 5240(achieved), 5360.

---The uptrend will ‘terminate’ below 5169.

• In the short term,

---Nifty is now in uptrend (from 18th Jan.) with targets of 5310, 5340, 5370.

----The uptrend will ‘terminate’ below 5229.

Friday, January 15, 2010

NIFTY TREND-JAN 18

• Last swing bottom is at 5169 and swing top is at 5280.

• In the medium term,

--- Nifty is in uptrend (from 23rd Dec.) with targets of 5240(achieved), 5360.

---The uptrend will ‘terminate’ below 5160.

• In the short term,

---Nifty is in downtrend (from 12th Jan.) with targets of 5210(achieved), 5190(achieved), 5170(achieved).

----The downtrend will ‘terminate’ above 5280.

Thursday, January 14, 2010

Inverted Head and Shoulder in Nifty

Wednesday, January 13, 2010

Nifty Trend-Jan 14

• Last swing bottom is at 5169 and swing top is at 5300.

• In the medium term,

--- Nifty is in uptrend with targets of 5240(achieved), 5360.

---The uptrend will ‘terminate’ below 5160.

• In the short term,

---Nifty is in downtrend with targets of 5210(achieved), 5190(achieved), 5170(achieved).

----The downtrend will ‘terminate’ above 5300.

• In the medium term,

--- Nifty is in uptrend with targets of 5240(achieved), 5360.

---The uptrend will ‘terminate’ below 5160.

• In the short term,

---Nifty is in downtrend with targets of 5210(achieved), 5190(achieved), 5170(achieved).

----The downtrend will ‘terminate’ above 5300.

Nifty Trend-Jan 13

· Nifty made high and low of 5300 and 5201 on last trading day.

· Last swing top is at 5300.

· Trading above 5220, up move will be seen up to 5240, 5260, 5280.

· Below 5200, correction will be seen up to 5180, 5170, 5160.

· In the medium term, Nifty is in uptrend with targets of 5240(achieved), 5360. The uptrend will ‘terminate’ below 5160.

· In the short term, Nifty is now in downtrend with targets of 5210(achieved), 5190, 5170. The downtrend will terminate above 5300.

· Last swing top is at 5300.

· Trading above 5220, up move will be seen up to 5240, 5260, 5280.

· Below 5200, correction will be seen up to 5180, 5170, 5160.

· In the medium term, Nifty is in uptrend with targets of 5240(achieved), 5360. The uptrend will ‘terminate’ below 5160.

· In the short term, Nifty is now in downtrend with targets of 5210(achieved), 5190, 5170. The downtrend will terminate above 5300.

Tuesday, January 12, 2010

CUES FOR JAN 12

TECHNICAL CUES-------

• SGX Nifty is trading around 5238.

• Nifty made high and low of 5287 and 5228 on last trading day.

• Last swing bottom is at 5228 and swing top is at 5311.

• Trading above 5255, up move will be seen up to 5275, 5290, 5310.

• Below 5238, correction will be seen up to 5220, 5210, 5190.

• In the medium term, Nifty is in uptrend with targets of 5240(achieved), 5360. The uptrend will ‘terminate’ below 5160.

• In the short term, Nifty is in uptrend with targets of 5230(achieved), 5255(achieved), 5315(almost achieved). The uptrend will ‘terminate’ below 5228.

• In the immediate term, Nifty is in corrective down move with targets of 5235(achieved), 5210, 5190.

DERIVATIVE CUES----

• Nifty January future premium increased to 6 points so cost of carry increased. (Bullish)

• Nifty open interest increased by 10 lacs suggests long addition. (Total OI now at 2.62 cr)

• Nifty calls added 12 lacs and puts added 7 lacs in open interest. (Bearish)

• Nifty open interest put-call ratio is at 1.22.

• 5200 puts had open interest of 49 lacs (+8%) and 5300 calls had open interest of 52 lacs (+9%), so 5200 and 5300 will be important levels to watch for.

• India VIX closed at 22.68, increased by 0.5% suggests instability. (Bearish)

• In Nifty stocks, advance-decline ratio is 30/19. (Bullish)

Link for Nifty Future 60 minute chart added in the intraday chart section.

• SGX Nifty is trading around 5238.

• Nifty made high and low of 5287 and 5228 on last trading day.

• Last swing bottom is at 5228 and swing top is at 5311.

• Trading above 5255, up move will be seen up to 5275, 5290, 5310.

• Below 5238, correction will be seen up to 5220, 5210, 5190.

• In the medium term, Nifty is in uptrend with targets of 5240(achieved), 5360. The uptrend will ‘terminate’ below 5160.

• In the short term, Nifty is in uptrend with targets of 5230(achieved), 5255(achieved), 5315(almost achieved). The uptrend will ‘terminate’ below 5228.

• In the immediate term, Nifty is in corrective down move with targets of 5235(achieved), 5210, 5190.

DERIVATIVE CUES----

• Nifty January future premium increased to 6 points so cost of carry increased. (Bullish)

• Nifty open interest increased by 10 lacs suggests long addition. (Total OI now at 2.62 cr)

• Nifty calls added 12 lacs and puts added 7 lacs in open interest. (Bearish)

• Nifty open interest put-call ratio is at 1.22.

• 5200 puts had open interest of 49 lacs (+8%) and 5300 calls had open interest of 52 lacs (+9%), so 5200 and 5300 will be important levels to watch for.

• India VIX closed at 22.68, increased by 0.5% suggests instability. (Bearish)

• In Nifty stocks, advance-decline ratio is 30/19. (Bullish)

Link for Nifty Future 60 minute chart added in the intraday chart section.

Friday, January 8, 2010

Nifty--Big move is coming?

Thursday, January 7, 2010

Monday, January 4, 2010

CUES FOR JAN 4

TECHNICAL CUES-------

• SGX Nifty is trading around 5225.

• Nifty made high and low of 5222 and 5169 on last trading day.

• Last swing bottom is at 5160.

• Trading above 5213, up move will be seen up to 5230, 5245, 5260.

• Below 5190, correction will be seen up to 5180, 5170, 5160.

• In the medium term, Nifty is in uptrend with targets of 5240, 5360. The uptrend will ‘terminate’ below 4944.

• In the short term, Nifty is now in uptrend with targets of 5230, 5255, 5315. The uptrend will ‘terminate’ below 5160.

DERIVATIVE CUES----

• Nifty January future premium increased to 14 points so cost of carry increased. (Bullish)

• Nifty open interest decreased by 74 lacs suggests short covering. (Total OI now at 2.25 cr)

• Nifty open interest put-call ratio is at 1.22.

• 5000 puts had open interest of 38 lacs (+18%) and 5300 calls had open interest of 27 lacs (+52%), so 5000 and 5300 will be important levels to watch for.

• India VIX closed at 23.34, decreased by 5% suggests stability. (Bullish)

• In Nifty stocks, advance-decline ratio is 35/15. (Bullish)

• SGX Nifty is trading around 5225.

• Nifty made high and low of 5222 and 5169 on last trading day.

• Last swing bottom is at 5160.

• Trading above 5213, up move will be seen up to 5230, 5245, 5260.

• Below 5190, correction will be seen up to 5180, 5170, 5160.

• In the medium term, Nifty is in uptrend with targets of 5240, 5360. The uptrend will ‘terminate’ below 4944.

• In the short term, Nifty is now in uptrend with targets of 5230, 5255, 5315. The uptrend will ‘terminate’ below 5160.

DERIVATIVE CUES----

• Nifty January future premium increased to 14 points so cost of carry increased. (Bullish)

• Nifty open interest decreased by 74 lacs suggests short covering. (Total OI now at 2.25 cr)

• Nifty open interest put-call ratio is at 1.22.

• 5000 puts had open interest of 38 lacs (+18%) and 5300 calls had open interest of 27 lacs (+52%), so 5000 and 5300 will be important levels to watch for.

• India VIX closed at 23.34, decreased by 5% suggests stability. (Bullish)

• In Nifty stocks, advance-decline ratio is 35/15. (Bullish)

Subscribe to:

Posts (Atom)