CUES-

--Nifty July future premium decreased to 9 points so cost of carry decreased.

--Nifty open interest increased by 7 lacs suggests short addition. (Total OI now at 2.19cr)

--Nifty calls added 28 lacs and puts added 26 lacs in open interest.

--Nifty open interest put-call ratio is at 0.94.

--4200 puts had open interest of 23 lacs and 4500 calls had open interest of 14 lacs, so 4200 and 4500 will be important levels to watch for.

--India VIX closed at 37.00, decreased by 1.5% suggests stability.

-- US markets closed mixed.

--Asian markets trading mixed.

--Sgx nifty trading at 4400. (Up 16)

********Positional strategy for nifty—

---IDEAL STRATEGY— INITIATE LONG.

---CLOSING STOPLOSS FOR LONG—4228.

---CLOSING STOPLOSS FOR SHORT—4343. (Stopped out)

---All are invited to visit my new blog on real time nifty trading using three averages at

http://niftydoctor-trading.blogspot.com/

Monday, June 29, 2009

Thursday, June 25, 2009

CUES FOR JUNE 25

CUES-

--Nifty June future premium increased to 12 points so cost of carry increased.

--Nifty open interest increased by 8 lacs suggests long addition. (Total OI now at 3.56cr)

--Nifty calls shed 4 lacs and puts added 24 lacs in open interest.

--Nifty open interest put-call ratio is at 0.88.

--4200 puts had open interest of 44 lacs and 4400 calls had open interest of 31 lacs, so 4200 and 4400 will be important levels to watch for.

--India VIX closed at 42.22, decreased by 12% suggests stability.

-- US markets closed mixed.

--Asian markets trading positive.

--Sgx nifty trading at 4343 (Up 38)

********Positional strategy for nifty—

---IDEAL STRATEGY— HOLD SHORT.

---CLOSING STOPLOSS FOR LONG—4194.

---CLOSING STOPLOSS FOR SHORT—4309.

--Nifty June future premium increased to 12 points so cost of carry increased.

--Nifty open interest increased by 8 lacs suggests long addition. (Total OI now at 3.56cr)

--Nifty calls shed 4 lacs and puts added 24 lacs in open interest.

--Nifty open interest put-call ratio is at 0.88.

--4200 puts had open interest of 44 lacs and 4400 calls had open interest of 31 lacs, so 4200 and 4400 will be important levels to watch for.

--India VIX closed at 42.22, decreased by 12% suggests stability.

-- US markets closed mixed.

--Asian markets trading positive.

--Sgx nifty trading at 4343 (Up 38)

********Positional strategy for nifty—

---IDEAL STRATEGY— HOLD SHORT.

---CLOSING STOPLOSS FOR LONG—4194.

---CLOSING STOPLOSS FOR SHORT—4309.

Wednesday, June 24, 2009

CUES FOR JUNE 24

CUES-

--Nifty June future premium increased to 0.9 point so cost of carry increased.

--Nifty open interest increased by 9 lacs suggests long addition. (Total OI now at 3.48cr)

--Nifty calls added 14 lacs and puts added 6 lacs in open interest.

--Nifty open interest put-call ratio is at 0.83.

--4200 puts had open interest of 35 lacs and 4400 calls had open interest of 32 lacs, so 4200 and 4400 will be important levels to watch for.

--India VIX closed at 48.23, increased by 1.5% suggests instability.

-- US markets closed mixed.

--Asian markets trading mixed.

--Sgx nifty trading at 4217 (Down 13)

********Positional strategy for nifty—

---IDEAL STRATEGY— HOLD SHORT.

---CLOSING STOPLOSS FOR LONG—4191.

---CLOSING STOPLOSS FOR SHORT—4315.

--Nifty June future premium increased to 0.9 point so cost of carry increased.

--Nifty open interest increased by 9 lacs suggests long addition. (Total OI now at 3.48cr)

--Nifty calls added 14 lacs and puts added 6 lacs in open interest.

--Nifty open interest put-call ratio is at 0.83.

--4200 puts had open interest of 35 lacs and 4400 calls had open interest of 32 lacs, so 4200 and 4400 will be important levels to watch for.

--India VIX closed at 48.23, increased by 1.5% suggests instability.

-- US markets closed mixed.

--Asian markets trading mixed.

--Sgx nifty trading at 4217 (Down 13)

********Positional strategy for nifty—

---IDEAL STRATEGY— HOLD SHORT.

---CLOSING STOPLOSS FOR LONG—4191.

---CLOSING STOPLOSS FOR SHORT—4315.

Monday, June 22, 2009

cues for june 22

CUES-

--Nifty June future premium decreased to 10 points so cost of carry decreased.

--Nifty open interest decreased by 5 lacs suggests long unwinding. (Total OI now at 3.41cr)

--Nifty calls shed 1 lac and puts shed 2 lacs in open interest.

--Nifty open interest put-call ratio is at 0.85.

--4200 puts had open interest of 31 lacs and 4400 calls had open interest of 34 lacs, so 4200 and 4400 will be important levels to watch for.

--India VIX closed at 48.95, decreased by 10% suggests stability.

--US markets closed in green.

--Asian markets trading mixed.

--Sgx nifty trading at 4300. (Down 23)

********Positional strategy for nifty—

---IDEAL STRATEGY— HOLD SHORT.

---CLOSING STOPLOSS FOR LONG—4254.

---CLOSING STOPLOSS FOR SHORT—4406.

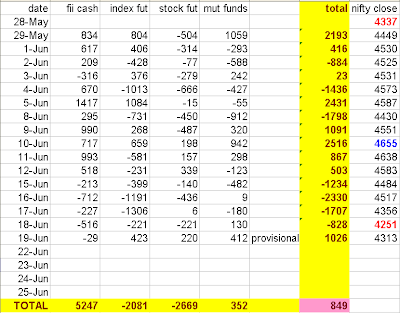

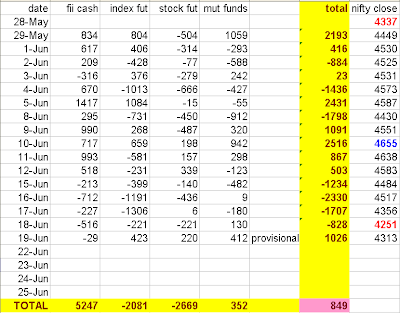

********FUND FLOW UPDATE FOR JUNE SERIES******

--Nifty June future premium decreased to 10 points so cost of carry decreased.

--Nifty open interest decreased by 5 lacs suggests long unwinding. (Total OI now at 3.41cr)

--Nifty calls shed 1 lac and puts shed 2 lacs in open interest.

--Nifty open interest put-call ratio is at 0.85.

--4200 puts had open interest of 31 lacs and 4400 calls had open interest of 34 lacs, so 4200 and 4400 will be important levels to watch for.

--India VIX closed at 48.95, decreased by 10% suggests stability.

--US markets closed in green.

--Asian markets trading mixed.

--Sgx nifty trading at 4300. (Down 23)

********Positional strategy for nifty—

---IDEAL STRATEGY— HOLD SHORT.

---CLOSING STOPLOSS FOR LONG—4254.

---CLOSING STOPLOSS FOR SHORT—4406.

********FUND FLOW UPDATE FOR JUNE SERIES******

Sunday, June 21, 2009

EGO, EMOTION AND TRADING

Your Emotions and Trading ...

By: Terry Ashman

Musashi, a legendary seventeenth century Japanese Samurai, formulated rules for warfare which are still used by Japanese business people today.

One rule is ...

Plan logically, but attack with emotion.

While this rule is suitable for a physical battle, if you use it while trading, you are at a supreme disadvantage. To apply it to trading, the rule should read ...

Plan logically, and attack (trade) WITHOUT emotion.

A number of psychologists have noted that normal human behavioral patterns are unsuited to trading the markets. Normal human responses to winning and losing will cause people to do exactly the wrong thing at the wrong time in the markets.

To illustrate ...

1. Take the situation where you have a long position and it immediately goes into profit. The normal human response is to want to take the profit quickly. This gives immediate gratification and removes any fear you may have had of losing the profit while the trade was on. This results in the situation called "cutting your profits short."

2. The opposite situation is when you put on a trade (again let's say it's a long position), and it goes against you. The normal human response is to hang on to the losing trade and hope it comes back and gives you a profit. But it keeps going down, so now you want it to come back so you can at least break even.

But it still goes down, so now you hope it will come back and give you a small loss. Down it goes further and you now have a big loss but you don't want to take the loss because it is emotionally painful to take losses. So you keep delaying the pain and losing more money.

If you are trading non-leveraged stocks, (that is, you have bought the shares outright and have paid for them in full), by now you may rationalize the loss by calling it a "long term investment" and just hang on to the shares. After all, if you sold now you'd lose heaps.

If you were trading in leveraged commodities you could be in real financial trouble at this point. This situation is called "letting your losses run."

You'll notice that cutting your profits short and letting your losses run is the exact opposite of what you are supposed to do, which is cutting your losses short and letting your profits run.

3. Now let's go back to the first situation where you've taken your profit quickly and you have your immediate gratification and removal of anxiety. You have a nice little profit but now the market is still going up. If you'd hung on you could have made even more! You get out your calculator, work out how much money you should have made by now, and think about what you could have done with that money. So you ring your broker and buy in again, noting with satisfaction that the front page news headline now reads ...

"Bulls Roar in Market Surge"

The market messes around for the next week or so and then starts to drift a bit lower, but you hang on because the broker says it's just a temporary reaction and anyhow, the media is still full of reasonably bullish news.

You hang on for a few more days but the market just keeps going down. Now the media has turned bearish.

What went wrong?A number of things. Let's list them ...

1. Greed. You looked at all the money you thought you should have made and jumped back in - just as the market was topping.

2. You "spent" the money you thought you should have made. You must never do this.

3. You listened to the media. You used the media to back up your decision to get back in, not realizing that the media is not a predictor, it's a follower. It just reports what has happened, usually when it's all over. Never trade on the news. Once the bull market hits the front page news and you decide to buy in on the strength of this news, you are trading with the mob - not the smart money.

4. You listened to the broker. If you've got a properly researched and tested trading method that you know intimately and have confidence in, you don't need or want the broker's advice on specifically when to buy and sell. Remember - the buck stops with you.

5. You exited your original position based on emotion, not logic.

Let's see what Gann says about this aspect of trading ... On page 16 of "How to Make Profits in Commodities", Gann says ...

"WHAT TRADERS DON'T WANT TO KNOW. With all due respect to my readers, many traders when they are in the market don't want to know the facts and don't want to know the truth. They hope the market will go their way. They want it to go their way and want to be told that it will. When you are in the market you should be unbiased and try to determine whether you are in right or wrong. When you find you are in wrong, admit it quickly and get out. Our old rule is, when in doubt, get out. When you have nothing to hold on for but hope, sell out at the market quickly. Don't look for the man who will advise you that your position is right and that the market will soon start going your way. Look for the man that will tell you the truth and prove it to you. Better still, learn how to prove it to yourself whether you are right or wrong. Face the facts. Change your position. Change your mind. Change with the trend and you will make profits."

On page 17 of "How to Make Profits in Commodities", Gann says . "HOPE AND FEAR: ........ The average man or woman buys commodities because they hope they will go up or because somebody advises them they will go up. This is the most dangerous thing to do. Never trade on hope. Hope wrecks more people than anything else. Study the market and determine the trend. Face the facts, and when you trade, trade on facts, eliminate hope."

"Fear causes many losses. People sell out because they fear commodities are going lower, but they often wait until the decline has run its course and they sell near the bottom. Often when they have been out of the market for some time, they get in because they fear it is going higher. Never make a trade on fear. The Bible says, "Ye shall know the truth and the truth shall make you free." Know the facts and know the truth. When you do this, you will have no hope and no fear and you will trade on well defined rules and go with the trend and will make profits."

That last sentence is very important. "When you do this, you will have no hope and no fear (trade without emotion) and you will trade on well defined rules and go with the trend and will make profits."

Other quotes from Gann on this subject ... "You will never succeed buying or selling when you hope the market is going up or down. You will never succeed by making a trade because you fear the market is going up or down. Hope will ruin you because it is nothing more than wishful thinking and provides no basis for action. Fear will often save you if you act quickly when you see that you are wrong. "The fear of the market is the beginning of wisdom". Knowledge that you can only obtain by deep study will help you to make a success. The more you study past records the surer you are to be able to detect the trend in the future."

"Remember, never buck the trend : after you detect the trend, go with it regardless of what you think, hope or fear and you will make a success."

"People often write me and say "You were bearish on a certain stock on such and such a date; now .........you are bullish on it. My answer is "A wise man changes his mind, a fool never." ............ "Go into the market to make money and be ready to change sides when the occasion demands it."

Your Ego and Trading ...

By: Terry Ashman

If you take a long or short position in the market, the market doesn't care what price you got in at. It doesn't care what price anyone got in or out at. It doesn't care about your analysis or your trading methods.

The market is totally impassive. It is always right. It rolls along and no-one can tell it what to do. If it doesn't go where your analysis and your trading methods say it should, and you are losing money, it's no good blaming the market, your broker, or even your trading method.

If you are a "high powered" business executive who can manipulate and persuade people, it won't work on the market. The market is impassive and takes no notice.

If you take some losses and get emotionally upset, and aim your fury at the market, it won't work. The market will not respond to you. It's impassive and takes no notice.

If you take some losses and aim your emotional fury at your broker, it won't work. He'll probably be impassive and take no notice either!

If you take some big wins and in your elation imagine that you are now the Omnipotent Master Trader, be careful because you are now emotionally very vulnerable. Don't let your suddenly acquired wealth and your feeling of euphoria cause you to get careless with your trading methods or your money management. Don't, whatever you do, bet too large a proportion of your account on the next trade!

On Page 6 of Gann's Stock Market Course, Gann Says ..."You must learn to realize that you cannot make the market go your way, you must go the market's way and must follow the trend. Many successful businessmen who are accustomed to giving orders to others and have them carried out will often, when they get into the market, especially for the first time, expect the market to follow their orders and move their way. They must learn that they cannot make the market trend go their way. They must follow the market trend as indicated by fixed rules and protect their capital and profits with STOP LOSS orders."

This point concerning "They must learn that they cannot make the market trend go their way" actually happens far more often than most people realise. The classic repeating example is the Australian government's reaction to the fall in the Australian dollar currently in the news (10th June 1998). The government don't want the dollar to fall too much more so they step in and buy. This invariably results in a small rally and then the dollar falls again. Government buying will not halt the established downtrend. Every government of every country does this. The Swiss did it when the Swiss franc was falling, the US government did it when the US dollar was falling, the Hawk Government did it when the Australian dollar was falling back then. And leaders in government are "accustomed to giving orders to others and have them carried out", but they can't turn an established downtrend by buying heavily because the downtrend has not finished yet. As soon as they stop buying it will resume. In fact, their buying sets up nice rallies on which to sell short for short term trades.

A further example is the Hong Kong government's reaction to the fall in the Hong Kong share market, reported in the "Courier Mail" September 1st 1998 ..."A savage 7% plunge in Hong Kong share prices rocked the Asian markets yesterday ..... After spending the past two weeks pouring more than $HK100 billion ($23 billion Australian dollars) into the share market in an attempt to fight speculators and lift the Hang Seng off five year lows, the Hong Kong government ended its intervention yesterday. ......... In turn, the Hang Seng plummeted 554 points to close at 7275........"

The speculators they are "fighting" are the frightened investors selling shares. When hundreds of thousands or even millions of people are all panicking and losing money, no force on the planet is going to stop them from bailing out!

What all these points come down to is that ...1. No matter what happens to you in the market, you must take full responsibility for it yourself. You can't blame anybody else. The buck stops with you.

2. Maintain a calm, level-headed approach and treat trading as a business.

Gann says ..."HUMAN ELEMENT THE GREATEST WEAKNESS"When a trader makes a profit, he gives himself credit and feels that his judgement is good and that he did it all himself. When he takes losses, he takes a different attitude and seldom ever blames himself or tries to find the cause with himself for the losses. He finds excuses; reasons with himself that the unexpected happened, and that if he had not lisened to someone elses advice, he would have made a profit. He finds a lot of ifs, ands, and buts, which he imagines were no fault of his. This is why he makes mistakes and losses a second time".

"The investor and trader must work out his own salvation and blame himself and no one else for his losses, for unless he does, he will never be able to correct his weaknesses. After all, it is your own acts that cause your losses because you did the buying and the selling. You must look for the trouble within and correct it. Then you will make a success, and not before."

From http://www.afsd.com.au/article/hottrader/solomn14a.htm

and http://www.afsd.com.au/article/hottrader/solomn15a.htm

By: Terry Ashman

Musashi, a legendary seventeenth century Japanese Samurai, formulated rules for warfare which are still used by Japanese business people today.

One rule is ...

Plan logically, but attack with emotion.

While this rule is suitable for a physical battle, if you use it while trading, you are at a supreme disadvantage. To apply it to trading, the rule should read ...

Plan logically, and attack (trade) WITHOUT emotion.

A number of psychologists have noted that normal human behavioral patterns are unsuited to trading the markets. Normal human responses to winning and losing will cause people to do exactly the wrong thing at the wrong time in the markets.

To illustrate ...

1. Take the situation where you have a long position and it immediately goes into profit. The normal human response is to want to take the profit quickly. This gives immediate gratification and removes any fear you may have had of losing the profit while the trade was on. This results in the situation called "cutting your profits short."

2. The opposite situation is when you put on a trade (again let's say it's a long position), and it goes against you. The normal human response is to hang on to the losing trade and hope it comes back and gives you a profit. But it keeps going down, so now you want it to come back so you can at least break even.

But it still goes down, so now you hope it will come back and give you a small loss. Down it goes further and you now have a big loss but you don't want to take the loss because it is emotionally painful to take losses. So you keep delaying the pain and losing more money.

If you are trading non-leveraged stocks, (that is, you have bought the shares outright and have paid for them in full), by now you may rationalize the loss by calling it a "long term investment" and just hang on to the shares. After all, if you sold now you'd lose heaps.

If you were trading in leveraged commodities you could be in real financial trouble at this point. This situation is called "letting your losses run."

You'll notice that cutting your profits short and letting your losses run is the exact opposite of what you are supposed to do, which is cutting your losses short and letting your profits run.

3. Now let's go back to the first situation where you've taken your profit quickly and you have your immediate gratification and removal of anxiety. You have a nice little profit but now the market is still going up. If you'd hung on you could have made even more! You get out your calculator, work out how much money you should have made by now, and think about what you could have done with that money. So you ring your broker and buy in again, noting with satisfaction that the front page news headline now reads ...

"Bulls Roar in Market Surge"

The market messes around for the next week or so and then starts to drift a bit lower, but you hang on because the broker says it's just a temporary reaction and anyhow, the media is still full of reasonably bullish news.

You hang on for a few more days but the market just keeps going down. Now the media has turned bearish.

What went wrong?A number of things. Let's list them ...

1. Greed. You looked at all the money you thought you should have made and jumped back in - just as the market was topping.

2. You "spent" the money you thought you should have made. You must never do this.

3. You listened to the media. You used the media to back up your decision to get back in, not realizing that the media is not a predictor, it's a follower. It just reports what has happened, usually when it's all over. Never trade on the news. Once the bull market hits the front page news and you decide to buy in on the strength of this news, you are trading with the mob - not the smart money.

4. You listened to the broker. If you've got a properly researched and tested trading method that you know intimately and have confidence in, you don't need or want the broker's advice on specifically when to buy and sell. Remember - the buck stops with you.

5. You exited your original position based on emotion, not logic.

Let's see what Gann says about this aspect of trading ... On page 16 of "How to Make Profits in Commodities", Gann says ...

"WHAT TRADERS DON'T WANT TO KNOW. With all due respect to my readers, many traders when they are in the market don't want to know the facts and don't want to know the truth. They hope the market will go their way. They want it to go their way and want to be told that it will. When you are in the market you should be unbiased and try to determine whether you are in right or wrong. When you find you are in wrong, admit it quickly and get out. Our old rule is, when in doubt, get out. When you have nothing to hold on for but hope, sell out at the market quickly. Don't look for the man who will advise you that your position is right and that the market will soon start going your way. Look for the man that will tell you the truth and prove it to you. Better still, learn how to prove it to yourself whether you are right or wrong. Face the facts. Change your position. Change your mind. Change with the trend and you will make profits."

On page 17 of "How to Make Profits in Commodities", Gann says . "HOPE AND FEAR: ........ The average man or woman buys commodities because they hope they will go up or because somebody advises them they will go up. This is the most dangerous thing to do. Never trade on hope. Hope wrecks more people than anything else. Study the market and determine the trend. Face the facts, and when you trade, trade on facts, eliminate hope."

"Fear causes many losses. People sell out because they fear commodities are going lower, but they often wait until the decline has run its course and they sell near the bottom. Often when they have been out of the market for some time, they get in because they fear it is going higher. Never make a trade on fear. The Bible says, "Ye shall know the truth and the truth shall make you free." Know the facts and know the truth. When you do this, you will have no hope and no fear and you will trade on well defined rules and go with the trend and will make profits."

That last sentence is very important. "When you do this, you will have no hope and no fear (trade without emotion) and you will trade on well defined rules and go with the trend and will make profits."

Other quotes from Gann on this subject ... "You will never succeed buying or selling when you hope the market is going up or down. You will never succeed by making a trade because you fear the market is going up or down. Hope will ruin you because it is nothing more than wishful thinking and provides no basis for action. Fear will often save you if you act quickly when you see that you are wrong. "The fear of the market is the beginning of wisdom". Knowledge that you can only obtain by deep study will help you to make a success. The more you study past records the surer you are to be able to detect the trend in the future."

"Remember, never buck the trend : after you detect the trend, go with it regardless of what you think, hope or fear and you will make a success."

"People often write me and say "You were bearish on a certain stock on such and such a date; now .........you are bullish on it. My answer is "A wise man changes his mind, a fool never." ............ "Go into the market to make money and be ready to change sides when the occasion demands it."

Your Ego and Trading ...

By: Terry Ashman

If you take a long or short position in the market, the market doesn't care what price you got in at. It doesn't care what price anyone got in or out at. It doesn't care about your analysis or your trading methods.

The market is totally impassive. It is always right. It rolls along and no-one can tell it what to do. If it doesn't go where your analysis and your trading methods say it should, and you are losing money, it's no good blaming the market, your broker, or even your trading method.

If you are a "high powered" business executive who can manipulate and persuade people, it won't work on the market. The market is impassive and takes no notice.

If you take some losses and get emotionally upset, and aim your fury at the market, it won't work. The market will not respond to you. It's impassive and takes no notice.

If you take some losses and aim your emotional fury at your broker, it won't work. He'll probably be impassive and take no notice either!

If you take some big wins and in your elation imagine that you are now the Omnipotent Master Trader, be careful because you are now emotionally very vulnerable. Don't let your suddenly acquired wealth and your feeling of euphoria cause you to get careless with your trading methods or your money management. Don't, whatever you do, bet too large a proportion of your account on the next trade!

On Page 6 of Gann's Stock Market Course, Gann Says ..."You must learn to realize that you cannot make the market go your way, you must go the market's way and must follow the trend. Many successful businessmen who are accustomed to giving orders to others and have them carried out will often, when they get into the market, especially for the first time, expect the market to follow their orders and move their way. They must learn that they cannot make the market trend go their way. They must follow the market trend as indicated by fixed rules and protect their capital and profits with STOP LOSS orders."

This point concerning "They must learn that they cannot make the market trend go their way" actually happens far more often than most people realise. The classic repeating example is the Australian government's reaction to the fall in the Australian dollar currently in the news (10th June 1998). The government don't want the dollar to fall too much more so they step in and buy. This invariably results in a small rally and then the dollar falls again. Government buying will not halt the established downtrend. Every government of every country does this. The Swiss did it when the Swiss franc was falling, the US government did it when the US dollar was falling, the Hawk Government did it when the Australian dollar was falling back then. And leaders in government are "accustomed to giving orders to others and have them carried out", but they can't turn an established downtrend by buying heavily because the downtrend has not finished yet. As soon as they stop buying it will resume. In fact, their buying sets up nice rallies on which to sell short for short term trades.

A further example is the Hong Kong government's reaction to the fall in the Hong Kong share market, reported in the "Courier Mail" September 1st 1998 ..."A savage 7% plunge in Hong Kong share prices rocked the Asian markets yesterday ..... After spending the past two weeks pouring more than $HK100 billion ($23 billion Australian dollars) into the share market in an attempt to fight speculators and lift the Hang Seng off five year lows, the Hong Kong government ended its intervention yesterday. ......... In turn, the Hang Seng plummeted 554 points to close at 7275........"

The speculators they are "fighting" are the frightened investors selling shares. When hundreds of thousands or even millions of people are all panicking and losing money, no force on the planet is going to stop them from bailing out!

What all these points come down to is that ...1. No matter what happens to you in the market, you must take full responsibility for it yourself. You can't blame anybody else. The buck stops with you.

2. Maintain a calm, level-headed approach and treat trading as a business.

Gann says ..."HUMAN ELEMENT THE GREATEST WEAKNESS"When a trader makes a profit, he gives himself credit and feels that his judgement is good and that he did it all himself. When he takes losses, he takes a different attitude and seldom ever blames himself or tries to find the cause with himself for the losses. He finds excuses; reasons with himself that the unexpected happened, and that if he had not lisened to someone elses advice, he would have made a profit. He finds a lot of ifs, ands, and buts, which he imagines were no fault of his. This is why he makes mistakes and losses a second time".

"The investor and trader must work out his own salvation and blame himself and no one else for his losses, for unless he does, he will never be able to correct his weaknesses. After all, it is your own acts that cause your losses because you did the buying and the selling. You must look for the trouble within and correct it. Then you will make a success, and not before."

From http://www.afsd.com.au/article/hottrader/solomn14a.htm

and http://www.afsd.com.au/article/hottrader/solomn15a.htm

Friday, June 19, 2009

CUES FOR JUNE 19

CUES-

--Nifty June future discount converted in to premium of 13 points so cost of carry increased.

--Nifty open interest increased by 14 lacs suggests long addition. (Total OI now at 3.46cr)

--Nifty calls added 31 lacs and puts added 6 lacs in open interest.

--Nifty open interest put-call ratio is at 0.85.

--4200 puts had open interest of 32 lacs and 4400 calls had open interest of 31 lacs, so 4200 and 4400 will be important levels to watch for.

--India VIX closed at 54.49, decreased by 12% suggests stability.

--US markets closed in green.

--Asian markets trading mixed.

--Sgx nifty trading at 4305. (Up 23)

********Positional strategy for nifty—

---IDEAL STRATEGY— HOLD SHORT.

---CLOSING STOPLOSS FOR LONG—4320. (Stopped Out)

---CLOSING STOPLOSS FOR SHORT—4477.

--Nifty June future discount converted in to premium of 13 points so cost of carry increased.

--Nifty open interest increased by 14 lacs suggests long addition. (Total OI now at 3.46cr)

--Nifty calls added 31 lacs and puts added 6 lacs in open interest.

--Nifty open interest put-call ratio is at 0.85.

--4200 puts had open interest of 32 lacs and 4400 calls had open interest of 31 lacs, so 4200 and 4400 will be important levels to watch for.

--India VIX closed at 54.49, decreased by 12% suggests stability.

--US markets closed in green.

--Asian markets trading mixed.

--Sgx nifty trading at 4305. (Up 23)

********Positional strategy for nifty—

---IDEAL STRATEGY— HOLD SHORT.

---CLOSING STOPLOSS FOR LONG—4320. (Stopped Out)

---CLOSING STOPLOSS FOR SHORT—4477.

Thursday, June 18, 2009

cues for june 18

CUES-

--Nifty June future premium converted in to discount of 3 points so cost of carry decreased.

--Nifty open interest increased by 4 lacs suggests short addition. (Total OI now at 3.32cr)

--Nifty calls added 37 lacs and puts shed 10.5 lacs in open interest.

--4300 puts had open interest of 27 lacs, so 4300 will be important level to watch for.

--India VIX closed at 62.05, increased by 49% suggests instability and uncertainty.

--US markets closed mixed.

--Asian markets trading mixed.

--Sgx nifty trading at 4360. (up 20)

********Positional strategy for nifty—

---IDEAL STRATEGY— HOLD SHORT.

---CLOSING STOPLOSS FOR LONG—4403. (Stopped Out)

---CLOSING STOPLOSS FOR SHORT—4552.

--Nifty June future premium converted in to discount of 3 points so cost of carry decreased.

--Nifty open interest increased by 4 lacs suggests short addition. (Total OI now at 3.32cr)

--Nifty calls added 37 lacs and puts shed 10.5 lacs in open interest.

--4300 puts had open interest of 27 lacs, so 4300 will be important level to watch for.

--India VIX closed at 62.05, increased by 49% suggests instability and uncertainty.

--US markets closed mixed.

--Asian markets trading mixed.

--Sgx nifty trading at 4360. (up 20)

********Positional strategy for nifty—

---IDEAL STRATEGY— HOLD SHORT.

---CLOSING STOPLOSS FOR LONG—4403. (Stopped Out)

---CLOSING STOPLOSS FOR SHORT—4552.

****FUND FLOW UPDAT***

---Please note that data for 17th june are from tv media and all other data are from sebi website.

Tuesday, June 16, 2009

cues for june 16

CUES-

--Nifty June future premium increased to 16 points so cost of carry increased.

--Nifty open interest decreased by 2 lacs suggests short covering. (Total OI now at 3.12cr)

--Nifty calls added 2.3 lacs and puts shed 6 lacs in open interest.

--4200 puts had open interest of 30 lacs and 4600 calls had open interest of 31 lacs, so 4200 and 4600 will be important levels to watch for.

--India VIX closed at 52.71, increased by 29% suggests instability and uncertainity.

--US markets closed in red.

--Asian markets trading mixed.

--Sgx nifty trading at 4440. (Down 80)

********Positional strategy for nifty—

---IDEAL STRATEGY— INITIATE SHORT.

---CLOSING STOPLOSS FOR LONG—4541. (Stopped Out)

---CLOSING STOPLOSS FOR SHORT—4658.

--Nifty June future premium increased to 16 points so cost of carry increased.

--Nifty open interest decreased by 2 lacs suggests short covering. (Total OI now at 3.12cr)

--Nifty calls added 2.3 lacs and puts shed 6 lacs in open interest.

--4200 puts had open interest of 30 lacs and 4600 calls had open interest of 31 lacs, so 4200 and 4600 will be important levels to watch for.

--India VIX closed at 52.71, increased by 29% suggests instability and uncertainity.

--US markets closed in red.

--Asian markets trading mixed.

--Sgx nifty trading at 4440. (Down 80)

********Positional strategy for nifty—

---IDEAL STRATEGY— INITIATE SHORT.

---CLOSING STOPLOSS FOR LONG—4541. (Stopped Out)

---CLOSING STOPLOSS FOR SHORT—4658.

Sunday, June 14, 2009

cues for june 15

CUES-

--Nifty June future premium increased to 5.4 points so cost of carry increased.

--Nifty open interest decreased by 1.4 lacs suggests short covering. (Total OI now at 3.14cr)

--Nifty calls added 21.5 lacs and puts shed 9 lacs in open interest.

--4500 puts had open interest of 33 lacs and 4700 calls had open interest of 38 lacs, so 4500 and 4700 will be important levels to watch for.

--India VIX closed at 40.83, decreased by 0.5% suggests stability.

--US markets closed mixed.

********Positional strategy for nifty—

---IDEAL STRATEGY— HOLD LONG.

---CLOSING STOPLOSS FOR LONG—4568.

---CLOSING STOPLOSS FOR SHORT—4687.

********Positional strategy for GOLD—

---IDEAL STRATEGY— HOLD SHORT.

---CLOSING STOPLOSS FOR LONG—14464.

---CLOSING STOPLOSS FOR SHORT—14614.

********Positional strategy for CRUDE—

---IDEAL STRATEGY— HOLD LONG.

---CLOSING STOPLOSS FOR LONG—3394.

---CLOSING STOPLOSS FOR SHORT—3454.

--Nifty June future premium increased to 5.4 points so cost of carry increased.

--Nifty open interest decreased by 1.4 lacs suggests short covering. (Total OI now at 3.14cr)

--Nifty calls added 21.5 lacs and puts shed 9 lacs in open interest.

--4500 puts had open interest of 33 lacs and 4700 calls had open interest of 38 lacs, so 4500 and 4700 will be important levels to watch for.

--India VIX closed at 40.83, decreased by 0.5% suggests stability.

--US markets closed mixed.

********Positional strategy for nifty—

---IDEAL STRATEGY— HOLD LONG.

---CLOSING STOPLOSS FOR LONG—4568.

---CLOSING STOPLOSS FOR SHORT—4687.

********Positional strategy for GOLD—

---IDEAL STRATEGY— HOLD SHORT.

---CLOSING STOPLOSS FOR LONG—14464.

---CLOSING STOPLOSS FOR SHORT—14614.

********Positional strategy for CRUDE—

---IDEAL STRATEGY— HOLD LONG.

---CLOSING STOPLOSS FOR LONG—3394.

---CLOSING STOPLOSS FOR SHORT—3454.

Friday, June 12, 2009

cues for june 12

CUES-

--Nifty June future premium decreased to 4.8 points so cost of carry decreased.

--Nifty open interest decreased by 3 lacs suggests long unwinding. (Total OI now at 3.16cr)

--Nifty calls added 11 lacs and puts added 8 lacs in open interest.

--4500 puts had open interest of 35 lacs and 4700 calls had open interest of 29 lacs, so 4500 and 4700 will be important levels to watch for.

--India VIX closed at 41.02, increased by 1% suggests instability.

--US markets closed in green.

--Asian markets trading mixed.

--Sgx nifty trading at 4662. (Up 31)

--Positional strategy for nifty—

---IDEAL STRATEGY—LONG.

---CLOSING STOPLOSS FOR LONG—4501.

---CLOSING STOPLOSS FOR SHORT—4644.

--Nifty June future premium decreased to 4.8 points so cost of carry decreased.

--Nifty open interest decreased by 3 lacs suggests long unwinding. (Total OI now at 3.16cr)

--Nifty calls added 11 lacs and puts added 8 lacs in open interest.

--4500 puts had open interest of 35 lacs and 4700 calls had open interest of 29 lacs, so 4500 and 4700 will be important levels to watch for.

--India VIX closed at 41.02, increased by 1% suggests instability.

--US markets closed in green.

--Asian markets trading mixed.

--Sgx nifty trading at 4662. (Up 31)

--Positional strategy for nifty—

---IDEAL STRATEGY—LONG.

---CLOSING STOPLOSS FOR LONG—4501.

---CLOSING STOPLOSS FOR SHORT—4644.

Thursday, June 11, 2009

CUES FOR JUNE 11

CUES-

--Nifty June future premium increased to 5 points so cost of carry increased.

--Nifty open interest increased by 12 lacs suggests long addition. (Total OI now at 3.19cr)

--4500 puts had open interest of 34 lacs and 4700 calls had open interest of 24 lacs, so 4500 and 4700 will be important levels to watch for.

--India VIX closed at 40.47, decreased by 1% suggests stability.

--US markets closed in red.

--Asian markets trading negative.

--Sgx nifty trading at 4648. (Down 16)

--Positional strategy for nifty—

---IDEAL STRATEGY—LONG.

---CLOSING STOPLOSS FOR LONG—4440.

---CLOSING STOPLOSS FOR SHORT—4621.(Stopped out)

****From 10th March onwards our trading system had generated either 'long call' on nifty or 'neutral call' on nifty but so far had not generated any 'short call' on nifty*******

--Nifty June future premium increased to 5 points so cost of carry increased.

--Nifty open interest increased by 12 lacs suggests long addition. (Total OI now at 3.19cr)

--4500 puts had open interest of 34 lacs and 4700 calls had open interest of 24 lacs, so 4500 and 4700 will be important levels to watch for.

--India VIX closed at 40.47, decreased by 1% suggests stability.

--US markets closed in red.

--Asian markets trading negative.

--Sgx nifty trading at 4648. (Down 16)

--Positional strategy for nifty—

---IDEAL STRATEGY—LONG.

---CLOSING STOPLOSS FOR LONG—4440.

---CLOSING STOPLOSS FOR SHORT—4621.(Stopped out)

****From 10th March onwards our trading system had generated either 'long call' on nifty or 'neutral call' on nifty but so far had not generated any 'short call' on nifty*******

Wednesday, June 10, 2009

CUES FOR JUNE 10

CUES-

--Nifty June future premium decreased to 0.2 points so cost of carry decreased.

--Nifty open interest decreased by 1.1 lacs suggests long unwinding. (Total OI now at 3.07cr)

--Nifty calls shed 8 lacs and puts added 20 lacs in open interest.

--4400 puts had open interest of 29 lacs and 4600 calls had open interest of 28 lacs, so 4400 and 4600 will be important levels to watch for.

--India VIX closed at 40.76, decreased by 3.5% suggests stability.

--US markets closed flat.

--Asian markets trading positive.

--Sgx nifty trading at 4578. (Up 19)

--Positional strategy for nifty—

---IDEAL STRATEGY—NEUTRAL.

---CLOSING STOPLOSS FOR LONG—4444.

---CLOSING STOPLOSS FOR SHORT—4604.

--Nifty June future premium decreased to 0.2 points so cost of carry decreased.

--Nifty open interest decreased by 1.1 lacs suggests long unwinding. (Total OI now at 3.07cr)

--Nifty calls shed 8 lacs and puts added 20 lacs in open interest.

--4400 puts had open interest of 29 lacs and 4600 calls had open interest of 28 lacs, so 4400 and 4600 will be important levels to watch for.

--India VIX closed at 40.76, decreased by 3.5% suggests stability.

--US markets closed flat.

--Asian markets trading positive.

--Sgx nifty trading at 4578. (Up 19)

--Positional strategy for nifty—

---IDEAL STRATEGY—NEUTRAL.

---CLOSING STOPLOSS FOR LONG—4444.

---CLOSING STOPLOSS FOR SHORT—4604.

Tuesday, June 9, 2009

SHORT TERM VIEW

dear friend,

there is lot of confusion in traders about short term outlook for nifty.

I have attached chart for the same(which was prepared on sunday).

---nifty made top at 4509 after election(a).

---wave a of 979 points(from 3530 to 4509)

---then nifty corrected upto 4092(b).

---thus correction was of 417 points.(wave b)

---then nifty made top at 4637(c).

---wave c was of 545 points.(which is less then wave a)

---now we are in wave d which will be more then wave b(417 points).

---so wave d should end below 4220(4637-417) and should last 5-7 trading days.

---then pre-budget we will be in wave e.

please remember that this is my assumption only and do not trade on this basis only.

for trading we will rely more on our trading sysytem calls only.

with regards.

-niftydoctor.

there is lot of confusion in traders about short term outlook for nifty.

I have attached chart for the same(which was prepared on sunday).

---nifty made top at 4509 after election(a).

---wave a of 979 points(from 3530 to 4509)

---then nifty corrected upto 4092(b).

---thus correction was of 417 points.(wave b)

---then nifty made top at 4637(c).

---wave c was of 545 points.(which is less then wave a)

---now we are in wave d which will be more then wave b(417 points).

---so wave d should end below 4220(4637-417) and should last 5-7 trading days.

---then pre-budget we will be in wave e.

please remember that this is my assumption only and do not trade on this basis only.

for trading we will rely more on our trading sysytem calls only.

with regards.

-niftydoctor.

CUES FOR JUNE 9

CUES-

--Nifty June future premium decreased to 4 points so cost of carry decreased.

--Nifty open interest increased by 7 lacs suggests short addition. (Total OI now at 3.08cr)

--Nifty calls added 25 lacs and puts shed 5 lacs in open interest.

--4400 puts had open interest of 25 lacs and 4600 calls had open interest of 32 lacs, so 4400 and 4600 will be important levels to watch for.

--India VIX closed at 42.27, increased by 4% suggests instability.

--US markets closed flat.

--Asian markets trading negative.

--Sgx nifty trading at 4430. (Up 10)

--Positional strategy for nifty—

---IDEAL STRATEGY—NEUTRAL.

---CLOSING STOPLOSS FOR LONG—4473. (Stopped out)

---CLOSING STOPLOSS FOR SHORT—4610.

--Nifty June future premium decreased to 4 points so cost of carry decreased.

--Nifty open interest increased by 7 lacs suggests short addition. (Total OI now at 3.08cr)

--Nifty calls added 25 lacs and puts shed 5 lacs in open interest.

--4400 puts had open interest of 25 lacs and 4600 calls had open interest of 32 lacs, so 4400 and 4600 will be important levels to watch for.

--India VIX closed at 42.27, increased by 4% suggests instability.

--US markets closed flat.

--Asian markets trading negative.

--Sgx nifty trading at 4430. (Up 10)

--Positional strategy for nifty—

---IDEAL STRATEGY—NEUTRAL.

---CLOSING STOPLOSS FOR LONG—4473. (Stopped out)

---CLOSING STOPLOSS FOR SHORT—4610.

Saturday, June 6, 2009

CUES FOR JUNE 8

CUES-

--Nifty June future premium decreased to 5.4 points so cost of carry decreased.

--Nifty open interest increased by 6 lacs suggests short addition. (Total OI now at 3.01cr)

--Nifty calls added 6 lacs and puts added 23 lacs in open interest.

--4500 puts had open interest of 27 lacs, so 4500will be important level to watch for.

--India VIX closed at 40.55, decreased by 2% suggests stability.

--US markets closed flat.

--Positional strategy for nifty—

---IDEAL STRATEGY—LONG.

---CLOSING STOPLOSS FOR LONG—4498.

---CLOSING STOPLOSS FOR SHORT—4598.

--Nifty June future premium decreased to 5.4 points so cost of carry decreased.

--Nifty open interest increased by 6 lacs suggests short addition. (Total OI now at 3.01cr)

--Nifty calls added 6 lacs and puts added 23 lacs in open interest.

--4500 puts had open interest of 27 lacs, so 4500will be important level to watch for.

--India VIX closed at 40.55, decreased by 2% suggests stability.

--US markets closed flat.

--Positional strategy for nifty—

---IDEAL STRATEGY—LONG.

---CLOSING STOPLOSS FOR LONG—4498.

---CLOSING STOPLOSS FOR SHORT—4598.

Friday, June 5, 2009

CUES FOR JUNE 5

CUES-

--Nifty June future premium increased to 9.6 points so cost of carry increased.

--Nifty open interest increased by 11 lacs suggests long addition. (Total OI now at 2.95cr)

--Nifty calls added 3 lacs and puts added 10 lacs in open interest.

--4400 puts had open interest of 21 lacs, so 4400will be important level to watch for.

--India VIX closed at 41.31, increased by 1% suggests instability.

--US markets closed in green.

--Asian markets trading mixed.

--Sgx nifty trading at 4619. (Up 34)

--Positional strategy for nifty—

---IDEAL STRATEGY—LONG.

---CLOSING STOPLOSS FOR LONG—4461.

---CLOSING STOPLOSS FOR SHORT—4581.

--Nifty June future premium increased to 9.6 points so cost of carry increased.

--Nifty open interest increased by 11 lacs suggests long addition. (Total OI now at 2.95cr)

--Nifty calls added 3 lacs and puts added 10 lacs in open interest.

--4400 puts had open interest of 21 lacs, so 4400will be important level to watch for.

--India VIX closed at 41.31, increased by 1% suggests instability.

--US markets closed in green.

--Asian markets trading mixed.

--Sgx nifty trading at 4619. (Up 34)

--Positional strategy for nifty—

---IDEAL STRATEGY—LONG.

---CLOSING STOPLOSS FOR LONG—4461.

---CLOSING STOPLOSS FOR SHORT—4581.

Thursday, June 4, 2009

CUES FOR JUNE 4

CUES-

--Nifty June future premium increased to 5.5 points so cost of carry increased.

--Nifty open interest decreased by 4 lacs suggests short covering. (Total OI now at 2.84cr)

--Nifty calls added 20 lacs and puts added 29 lacs in open interest.

--4500 calls had open interest of 28 lacs and 4200 puts had open interest of 28 lacs, so 4500 and 4200will be important levels to watch for.

--India VIX closed at 40.67, decreased by 1% suggests stability.

--US markets closed in red.

--Asian markets trading mixed.

--Sgx nifty trading at 4515. (Down 15)

--Positional strategy for nifty—

---IDEAL STRATEGY—LONG.

---CLOSING STOPLOSS FOR LONG—4460.

---CLOSING STOPLOSS FOR SHORT—4569.

--Nifty June future premium increased to 5.5 points so cost of carry increased.

--Nifty open interest decreased by 4 lacs suggests short covering. (Total OI now at 2.84cr)

--Nifty calls added 20 lacs and puts added 29 lacs in open interest.

--4500 calls had open interest of 28 lacs and 4200 puts had open interest of 28 lacs, so 4500 and 4200will be important levels to watch for.

--India VIX closed at 40.67, decreased by 1% suggests stability.

--US markets closed in red.

--Asian markets trading mixed.

--Sgx nifty trading at 4515. (Down 15)

--Positional strategy for nifty—

---IDEAL STRATEGY—LONG.

---CLOSING STOPLOSS FOR LONG—4460.

---CLOSING STOPLOSS FOR SHORT—4569.

Wednesday, June 3, 2009

CUES FOR JUNE 3

CUES-

--Nifty June future premium decreased to 5 points so cost of carry decreased.

--Nifty open interest decreased by 4 lacs suggests long unwinding. (Total OI now at 2.88cr)

--Nifty calls added 12 lacs and puts added 8 lacs in open interest.

--4500 calls had open interest of 27 lacs and 4200 puts had open interest of 26 lacs, so 4500 and 4200will be important levels to watch for.

--India VIX closed at 41.04, decreased by 2% suggests stability.

--US markets closed in green.

--Asian markets trading mixed.

--Sgx nifty trading at 4525. (Down 5)

--Positional strategy for nifty—

---IDEAL STRATEGY—LONG.

---CLOSING STOPLOSS FOR LONG—4414.

---CLOSING STOPLOSS FOR SHORT—4540.

--Nifty June future premium decreased to 5 points so cost of carry decreased.

--Nifty open interest decreased by 4 lacs suggests long unwinding. (Total OI now at 2.88cr)

--Nifty calls added 12 lacs and puts added 8 lacs in open interest.

--4500 calls had open interest of 27 lacs and 4200 puts had open interest of 26 lacs, so 4500 and 4200will be important levels to watch for.

--India VIX closed at 41.04, decreased by 2% suggests stability.

--US markets closed in green.

--Asian markets trading mixed.

--Sgx nifty trading at 4525. (Down 5)

--Positional strategy for nifty—

---IDEAL STRATEGY—LONG.

---CLOSING STOPLOSS FOR LONG—4414.

---CLOSING STOPLOSS FOR SHORT—4540.

Tuesday, June 2, 2009

CUES FOR JUNE 2

CUES-

--Nifty June future premium increased to 8 points so cost of carry increased.

--Nifty open interest increased by 5 lacs suggests long addition. (Total OI now at 2.92cr)

--Nifty calls added 17 lacs and puts added 21 lacs in open interest.

--4500 calls had open interest of 25 lacs and 4200 puts had open interest of 24 lacs, so 4500 and 4200will be important levels to watch for.

--India VIX closed at 41.83, increased by 4% suggests instability.

--US markets closed in green.

--Asian markets trading positive.

--Sgx nifty trading at 4639. (Up 89)

--Positional strategy for nifty—

---IDEAL STRATEGY—LONG.

---CLOSING STOPLOSS FOR LONG—4349.

---CLOSING STOPLOSS FOR SHORT—4463. (Stopped out)

--Nifty June future premium increased to 8 points so cost of carry increased.

--Nifty open interest increased by 5 lacs suggests long addition. (Total OI now at 2.92cr)

--Nifty calls added 17 lacs and puts added 21 lacs in open interest.

--4500 calls had open interest of 25 lacs and 4200 puts had open interest of 24 lacs, so 4500 and 4200will be important levels to watch for.

--India VIX closed at 41.83, increased by 4% suggests instability.

--US markets closed in green.

--Asian markets trading positive.

--Sgx nifty trading at 4639. (Up 89)

--Positional strategy for nifty—

---IDEAL STRATEGY—LONG.

---CLOSING STOPLOSS FOR LONG—4349.

---CLOSING STOPLOSS FOR SHORT—4463. (Stopped out)

Subscribe to:

Posts (Atom)