-We have organized 'pap smear camp' at our hospital(Jigisha Nursing Home) on 29th November(Sunday) at 10AM.

-All female viewers residing in Ahmedabad are invited for the same.

-The camp is in collaboration with Reliance Life science and MSD pharmaceuticals.

-Dr.Jignesh Shah, Dr.Jigisha Shah.

what is pap smear??

read here http://niftydoctor-woman-health.blogspot.com/2009/11/paps-smear.html

Saturday, November 28, 2009

Friday, November 27, 2009

CUES FOR NOV 27

TECHNICAL CUES-------

• SGX Nifty is trading around 4915.

• Nifty made high and low of 5116 and 4986 on last trading day.

• Last swing top is at 5138.

• Trading above 5020, up move will be seen up to 5050, 5080.

• Below 4986, correction will continue up to 4950,4930. Below 4930, medium term up trend will also terminate.

• In the medium term, Nifty is in up trend with targets of 5160, 5230, 5330. Below 4932, medium term up trend will also terminate.

• In the short term, Nifty is in corrective down move with possible targets of 4960, 4930, 4890, 4838.

DERIVATIVE CUES----

• Nifty December future premium turned in to discount of 13 points so cost of carry decreased. (Bearish)

• Nifty open interest decreased by 96 lacs suggests long unwinding. (Total OI now at 2.54 cr)

• Nifty open interest put-call ratio is at 1.26.

• 4800 puts had open interest of 31 lacs (+24%) and 5100 calls had open interest of 36 lacs (+141%), so4800 and 5100 will be important levels to watch for.

• India VIX closed at 28.3, increased by 14% suggests instability. (Bearish)

• In Nifty stocks, advance-decline ratio is 6/43. (Bearish)

• SGX Nifty is trading around 4915.

• Nifty made high and low of 5116 and 4986 on last trading day.

• Last swing top is at 5138.

• Trading above 5020, up move will be seen up to 5050, 5080.

• Below 4986, correction will continue up to 4950,4930. Below 4930, medium term up trend will also terminate.

• In the medium term, Nifty is in up trend with targets of 5160, 5230, 5330. Below 4932, medium term up trend will also terminate.

• In the short term, Nifty is in corrective down move with possible targets of 4960, 4930, 4890, 4838.

DERIVATIVE CUES----

• Nifty December future premium turned in to discount of 13 points so cost of carry decreased. (Bearish)

• Nifty open interest decreased by 96 lacs suggests long unwinding. (Total OI now at 2.54 cr)

• Nifty open interest put-call ratio is at 1.26.

• 4800 puts had open interest of 31 lacs (+24%) and 5100 calls had open interest of 36 lacs (+141%), so4800 and 5100 will be important levels to watch for.

• India VIX closed at 28.3, increased by 14% suggests instability. (Bearish)

• In Nifty stocks, advance-decline ratio is 6/43. (Bearish)

Tuesday, November 24, 2009

CUES FOR NOV 24

TECHNICAL CUES-------

• MSCI India Index ETN (INP) closed at 62.3 (+1.7%)

• SGX Nifty is trading around 5100.

• Nifty made high and low of 5113 and 5052 on last trading day.

• Last swing bottom is at 4932.

• Trading above 5113, up move will continue up to 5130, 5160.

• Below 5080, correction will be seen up to 5060, 5040, 5010.

• In the medium term Nifty is in medium term up trend with targets of 5160, 5230, 5330.

• In the short term, Nifty is in short term uptrend with targets of 5042 (achieved), 5080 (achieved), 5150.

DERIVATIVE CUES----

• Nifty November future premium decreased to 5 points so cost of carry decreased. (Bearish)

• Nifty open interest increased by 4 lacs suggests short addition. (Total OI now at 3.10 cr)

• Nifty calls shed 19 lacs and puts added 5 lacs in open interest. (Bullish)

• Nifty open interest put-call ratio is at 1.60.

• 5000 puts had open interest of 52 lacs (-1%) and 5100 calls had open interest of 36 lacs (-10%), so 5000 and 5100 will be important levels to watch for.

• India VIX closed at 26.69, increased by 0.2% suggests instability. (Bearish)

• In Nifty stocks, advance-decline ratio is 29/21. (Bullish)

• MSCI India Index ETN (INP) closed at 62.3 (+1.7%)

• SGX Nifty is trading around 5100.

• Nifty made high and low of 5113 and 5052 on last trading day.

• Last swing bottom is at 4932.

• Trading above 5113, up move will continue up to 5130, 5160.

• Below 5080, correction will be seen up to 5060, 5040, 5010.

• In the medium term Nifty is in medium term up trend with targets of 5160, 5230, 5330.

• In the short term, Nifty is in short term uptrend with targets of 5042 (achieved), 5080 (achieved), 5150.

DERIVATIVE CUES----

• Nifty November future premium decreased to 5 points so cost of carry decreased. (Bearish)

• Nifty open interest increased by 4 lacs suggests short addition. (Total OI now at 3.10 cr)

• Nifty calls shed 19 lacs and puts added 5 lacs in open interest. (Bullish)

• Nifty open interest put-call ratio is at 1.60.

• 5000 puts had open interest of 52 lacs (-1%) and 5100 calls had open interest of 36 lacs (-10%), so 5000 and 5100 will be important levels to watch for.

• India VIX closed at 26.69, increased by 0.2% suggests instability. (Bearish)

• In Nifty stocks, advance-decline ratio is 29/21. (Bullish)

Monday, November 23, 2009

new blog on woman's health

all are invited to visit my new blog on woman's health.

it is for patient education about gynec problems.

the link is "http://niftydoctor-woman-health.blogspot.com/"

it is for patient education about gynec problems.

the link is "http://niftydoctor-woman-health.blogspot.com/"

Thursday, November 19, 2009

CUES FOR NOV 19

TECHNICAL CUES-------

• MSCI India Index ETN (INP) closed at 62.2 (- 0.8%)

• SGX Nifty is trading around 5053.

• Nifty made high and low of 5079 and 5041 on last trading day.

• Last swing bottom is at 4924 and swing top is at 5079.

• Trading above 5079, up move will continue up to 5090, 5120, 5150.

• Below 5041, correction will be seen up to 5030, 5010, 4990.

• In the medium term Nifty is in corrective down move with targets of 4700(achieved), 4550(achieved), 4400.

• In the short term, Nifty is in short term uptrend with targets of 5042 (achieved), 5080 (achieved), 5150.

DERIVATIVE CUES----

• Nifty November future premium decreased to 0.3 points so cost of carry decreased. (Bearish)

• Nifty open interest increased by 9 lacs suggests short addition. (Total OI now at 2.99 cr)

• Nifty calls added 7 lacs and puts added 14 lacs in open interest. (Bullish)

• Nifty open interest put-call ratio is at 1.54.

• 5000 puts had open interest of 54 lacs (+13%) and 5100 calls had open interest of 43 lacs (+9%), so 5000 and 5100 will be important levels to watch for.

• India VIX closed at 26.39, decreased by 1.5% suggests stability. (Bullish)

• In Nifty stocks, advance-decline ratio is 27/23. (Bullish)

• MSCI India Index ETN (INP) closed at 62.2 (- 0.8%)

• SGX Nifty is trading around 5053.

• Nifty made high and low of 5079 and 5041 on last trading day.

• Last swing bottom is at 4924 and swing top is at 5079.

• Trading above 5079, up move will continue up to 5090, 5120, 5150.

• Below 5041, correction will be seen up to 5030, 5010, 4990.

• In the medium term Nifty is in corrective down move with targets of 4700(achieved), 4550(achieved), 4400.

• In the short term, Nifty is in short term uptrend with targets of 5042 (achieved), 5080 (achieved), 5150.

DERIVATIVE CUES----

• Nifty November future premium decreased to 0.3 points so cost of carry decreased. (Bearish)

• Nifty open interest increased by 9 lacs suggests short addition. (Total OI now at 2.99 cr)

• Nifty calls added 7 lacs and puts added 14 lacs in open interest. (Bullish)

• Nifty open interest put-call ratio is at 1.54.

• 5000 puts had open interest of 54 lacs (+13%) and 5100 calls had open interest of 43 lacs (+9%), so 5000 and 5100 will be important levels to watch for.

• India VIX closed at 26.39, decreased by 1.5% suggests stability. (Bullish)

• In Nifty stocks, advance-decline ratio is 27/23. (Bullish)

Wednesday, November 18, 2009

CUES FOR NOV 18

TECHNICAL CUES-------

• MSCI India Index ETN (INP) closed at 62.7 (- 0.4%)

• SGX Nifty is trading around 5080.

• Nifty made high and low of 5074 and 5010 on last trading day.

• Last swing bottom is at 4924.

• Trading above 5074, up move will continue up to 5090, 5120, 5150.

• Below 5050, correction will be seen up to 5030, 5010, 4990.

• In the medium term Nifty is in corrective down move with targets of 4700(achieved), 4550(achieved), 4400.

• In the short term, Nifty is in short term uptrend with targets of 5042 (achieved), 5080 (almost achieved), 5150.

DERIVATIVE CUES----

• Nifty November future premium decreased to 1.1 points so cost of carry decreased. (Bearish)

• Nifty open interest increased by 10 lacs suggests long unwinding. (Total OI now at 2.9 cr)

• Nifty calls added 14 lacs and puts added 1.5 lacs in open interest. (Bearish)

• Nifty open interest put-call ratio is at 1.53.

• 5000 puts had open interest of 48 lacs (-1%) and 5100 calls had open interest of 39 lacs (+6%), so 5000 and 5100 will be important levels to watch for.

• India VIX closed at 26.78, decreased by 4% suggests stability. (Bullish)

• In Nifty stocks, advance-decline ratio is 23/27. (Bearish)

• MSCI India Index ETN (INP) closed at 62.7 (- 0.4%)

• SGX Nifty is trading around 5080.

• Nifty made high and low of 5074 and 5010 on last trading day.

• Last swing bottom is at 4924.

• Trading above 5074, up move will continue up to 5090, 5120, 5150.

• Below 5050, correction will be seen up to 5030, 5010, 4990.

• In the medium term Nifty is in corrective down move with targets of 4700(achieved), 4550(achieved), 4400.

• In the short term, Nifty is in short term uptrend with targets of 5042 (achieved), 5080 (almost achieved), 5150.

DERIVATIVE CUES----

• Nifty November future premium decreased to 1.1 points so cost of carry decreased. (Bearish)

• Nifty open interest increased by 10 lacs suggests long unwinding. (Total OI now at 2.9 cr)

• Nifty calls added 14 lacs and puts added 1.5 lacs in open interest. (Bearish)

• Nifty open interest put-call ratio is at 1.53.

• 5000 puts had open interest of 48 lacs (-1%) and 5100 calls had open interest of 39 lacs (+6%), so 5000 and 5100 will be important levels to watch for.

• India VIX closed at 26.78, decreased by 4% suggests stability. (Bullish)

• In Nifty stocks, advance-decline ratio is 23/27. (Bearish)

Monday, November 16, 2009

CUES FOR NOV 16

TECHNICAL CUES-------

• MSCI India Index ETN (INP) closed at 61.3 (+ 2%)

• SGX Nifty is trading around 5039.

• Nifty made high and low of 5018 and 4943 on last trading day.

• Last swing bottom is at 4924 and swing top is at 5017.

• Trading above 5020, up move will be seen up to 5040, 5055.

• Below 4970, correction will be seen up to 4940, 4920.

• In the medium term Nifty is in corrective down move with targets of 4700(achieved), 4550(achieved), 4400.

• In the short term, Nifty is in short term uptrend with targets of 5042, 5080, 5150. Below 4924, short term uptrend will be terminated.

DERIVATIVE CUES----

• Nifty November future premium increased to 4 points so cost of carry increased. (Bullish)

• Nifty open interest increased by 11 lacs suggests long addition. (Total OI now at 2.98 cr)

• Nifty calls shed 2.5 lacs and puts added 27 lacs in open interest. (Bullish)

• Nifty open interest put-call ratio is at 1.56.

• 4900 puts had open interest of 56 lacs (+ 17%) and 5100 calls had open interest of 33 lacs (+3%), so 4900 and 5100 will be important levels to watch for.

• India VIX closed at 29.09, decreased by 2% suggests stability. (Bullish)

• In Nifty stocks, advance-decline ratio is 33/17. (Bullish)

Thursday, November 12, 2009

Wednesday, November 11, 2009

CUES FOR NOV 12

TECHNICAL CUES-------

• Nifty made high and low of 5017 and 4870 on last trading day.

• Last swing bottom is at 4860.

• Trading above 5017, up move will continue up to 5042, 5055, 5080.

• Below 4950, correction will be seen up to 4920, 4890.

• In the medium term Nifty is in corrective down move with targets of 4700(achieved), 4550(achieved), 4400.

• In the short term, Nifty is in short term uptrend with targets of 5042, 5080, 5150.

DERIVATIVE CUES----

• Nifty November future discount converted in to premium of 6 points so cost of carry increased. (Bullish)

• Nifty open interest increased by 9 lacs suggests long addition. (Total OI now at 2.89 cr)

• Nifty calls shed 9 lacs and puts added 88 lacs in open interest. (Bullish)

• Nifty open interest put-call ratio is at 1.56.

• 4900 puts had open interest of 50 lacs (+82%) and 5000 calls had open interest of 36 lacs (-12%), so 4900 and 5000 will be important levels to watch for.

• India VIX closed at 28.96, decreased by 3.6% suggests stability. (Bullish)

• In Nifty stocks, advance-decline ratio is 47/3. (Bullish)

*** To view call performance of the E-mail service,

visit the blog at

www.niftydoctor-calls.blogspot.com

Tuesday, November 10, 2009

CUES FOR NOV 11

DERIVATIVE CUES----

• Nifty November future premium converted in to discount of 4.5 points so cost of carry decreased. (Bearish)

• Nifty open interest decreased by 13 lacs suggests long unwinding. (Total OI now at 2.80 cr)

• Nifty calls added 28 lacs and puts shed 0.5 lacs in open interest. (Bearish)

• Nifty open interest put-call ratio is at 1.34.

• 4700 puts had open interest of 57 lacs (+1%) and 4900 calls had open interest of 45 lacs (+36%), so 4700 and 4900 will be important levels to watch for.

• India VIX closed at 30.06, increased by 4% suggests instability. (Bearish)

• In Nifty stocks, advance-decline ratio is 14/35. (Bearish)

CUES FOR NOV 10

TECHNICAL CUES-------

• MSCI India Index ETN (INP) closed at 60.66 (+4%)

• SGX Nifty is trading around 4956.

• Nifty made high and low of 4905 and 4790 on last trading day.

• Last swing bottom is at 4538 and swing top is at 5055.

• Trading above 4905, up move will continue up to 4940, 4970.

• Below 4860, correction will be seen up to 4830, 4790, 4760.

• In the medium term Nifty is in corrective down move with targets of 4700(achieved), 4550(achieved), 4400.

• In the short term Nifty is in corrective up move with targets of 4780 (achieved), 4860(achieved). Above 4860, targets for corrective up move will be 4940, 4970.

DERIVATIVE CUES----

• Nifty November future discount converted in to premium of 5 points so cost of carry increased. (Bullish)

• Nifty open interest increased by 10 lacs suggests long addition. (Total OI now at 2.93 cr)

• Nifty calls shed 15 lacs and puts added 50 lacs in open interest. (Bullish)

• Nifty open interest put-call ratio is at 1.42.

• 4800 puts had open interest of 48 lacs (+62%) and 5000 calls had open interest of 33 lacs (-2%), so 4800 and 5000 will be important levels to watch for.

• India VIX closed at 28.92, decreased by 0.4% suggests stability. (Bullish)

• In Nifty stocks, advance-decline ratio is 44/6. (Bullish)

Monday, November 9, 2009

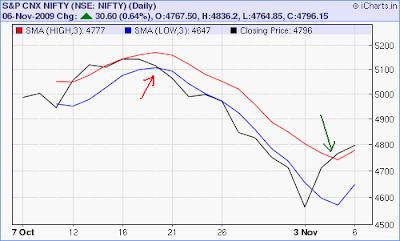

NEGATIVE DIVERGENCE

Saturday, November 7, 2009

CUES FOR NOV 9

TECHNICAL CUES-------

• MSCI India Index ETN (INP) closed at 58.11 (+0.4%)

• SGX Nifty was trading around 4770.

• Nifty made high and low of 4836 and 4765 on last trading day.

• Last swing bottom is at 4538 and swing top is at 5055.

• Trading above 4836, up move will continue up to 4860, 4880.

• Below 4765, correction will be seen up to 4730, 4700.

• In the medium term Nifty is in corrective down move with targets of 4700(achieved), 4550(achieved), 4400.

• In the short term Nifty is in corrective up move with targets of 4780 (achieved), 4860.

DERIVATIVE CUES----

• Nifty November future premium converted in to discount of 6 points so cost of carry decreased. (Bearish)

• Nifty open interest decreased by 5 lacs suggests long unwinding. (Total OI now at 2.83 cr)

• Nifty calls added 10 lacs and puts added 15 lacs in open interest. (Bullish)

• Nifty open interest put-call ratio is at 1.28.

• 4600 puts had open interest of 58 lacs (+18%) and 4900 calls had open interest of 42 lacs (+10%), so 4600 and 4900 will be important levels to watch for.

• India VIX closed at 29.04, decreased by 2% suggests stability. (Bullish)

• In Nifty stocks, advance-decline ratio is at 32/18. (Bullish)

Subscribe to:

Posts (Atom)