--Nifty June future premium decreased to 10 points so cost of carry decreased.

--Nifty open interest decreased by 5 lacs suggests long unwinding. (Total OI now at 3.41cr)

--Nifty calls shed 1 lac and puts shed 2 lacs in open interest.

--Nifty open interest put-call ratio is at 0.85.

--4200 puts had open interest of 31 lacs and 4400 calls had open interest of 34 lacs, so 4200 and 4400 will be important levels to watch for.

--India VIX closed at 48.95, decreased by 10% suggests stability.

--US markets closed in green.

--Asian markets trading mixed.

--Sgx nifty trading at 4300. (Down 23)

********Positional strategy for nifty—

---IDEAL STRATEGY— HOLD SHORT.

---CLOSING STOPLOSS FOR LONG—4254.

---CLOSING STOPLOSS FOR SHORT—4406.

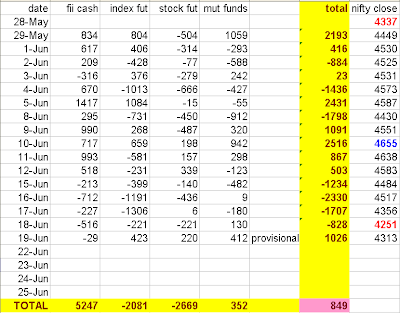

********FUND FLOW UPDATE FOR JUNE SERIES******