TECHNICAL CUES-------

• MSCI India Index ETN (INP) closed at 58.11 (+0.4%)

• SGX Nifty was trading around 4770.

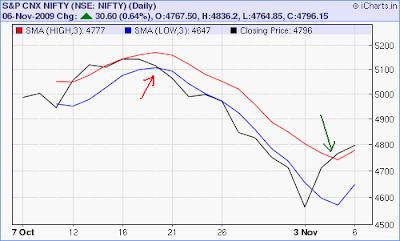

• Nifty made high and low of 4836 and 4765 on last trading day.

• Last swing bottom is at 4538 and swing top is at 5055.

• Trading above 4836, up move will continue up to 4860, 4880.

• Below 4765, correction will be seen up to 4730, 4700.

• In the medium term Nifty is in corrective down move with targets of 4700(achieved), 4550(achieved), 4400.

• In the short term Nifty is in corrective up move with targets of 4780 (achieved), 4860.

DERIVATIVE CUES----

• Nifty November future premium converted in to discount of 6 points so cost of carry decreased. (Bearish)

• Nifty open interest decreased by 5 lacs suggests long unwinding. (Total OI now at 2.83 cr)

• Nifty calls added 10 lacs and puts added 15 lacs in open interest. (Bullish)

• Nifty open interest put-call ratio is at 1.28.

• 4600 puts had open interest of 58 lacs (+18%) and 4900 calls had open interest of 42 lacs (+10%), so 4600 and 4900 will be important levels to watch for.

• India VIX closed at 29.04, decreased by 2% suggests stability. (Bullish)

• In Nifty stocks, advance-decline ratio is at 32/18. (Bullish)